Understanding “How to Calculate Coupon Rate of a Bond” Simplifies Bond Evaluation

Determining the coupon rate of a bond is a cornerstone of understanding bond valuation. The coupon rate, a fixed percentage, represents the annual interest payments made to bondholders. For example, a bond with a $1,000 face value and a 5% coupon rate entitles the holder to $50 in annual interest payments. Understanding coupon rate calculation empowers investors to assess bond investments and make informed decisions.

This article will delve into the formula, significance, benefits of understanding coupon rates, and a pivotal historical development that shaped the bond market.

How to Calculate Coupon Rate of a Bond

Understanding the essential aspects of calculating a bond’s coupon rate is crucial for bond evaluation.

- Formula

- Face Value

- Interest Payments

- Bond Price

- Yield to Maturity

- Bond Rating

- Historical Rates

- Market Conditions

These aspects are interconnected and provide comprehensive insights into bond valuation. The formula serves as the foundation for calculating the coupon rate, considering factors like face value and interest payments. Bond price and yield to maturity influence the attractiveness of bonds to investors. Bond rating and historical rates offer perspectives on the bond’s creditworthiness and past performance. Understanding market conditions helps assess the impact of economic factors on coupon rates.

Formula

The formula for calculating the coupon rate of a bond is a fundamental component of bond valuation, providing a precise method to determine the annual interest payments made to bondholders. Understanding this formula empowers investors to assess the attractiveness and suitability of bonds within their portfolios.

The coupon rate formula is: Coupon Rate = (Annual Interest Payment / Face Value) x 100%. For instance, a bond with a $1,000 face value and an annual interest payment of $50 has a coupon rate of 5%.

Comprehending the relationship between the formula and coupon rate calculation is crucial as it enables investors to accurately assess the return on their bond investments. By applying the formula, investors can compare different bonds, evaluate historical coupon rates, and make informed decisions aligned with their financial goals.

Face Value

Within the context of bond valuation, face value holds significant importance in determining the coupon rate of a bond. Face value, also known as par value, represents the principal amount borrowed by the bond issuer and repaid to the bondholder at maturity. It serves as the base upon which interest payments are calculated, directly impacting the coupon rate.

The relationship between face value and coupon rate is inversely proportional. A higher face value results in a lower coupon rate, while a lower face value leads to a higher coupon rate. This inverse relationship stems from the fact that the total annual interest payment remains constant regardless of the face value. As such, a higher face value spreads the same interest payment over a larger principal amount, resulting in a lower coupon rate. Conversely, a lower face value concentrates the interest payment on a smaller principal amount, leading to a higher coupon rate.

In real-world scenarios, understanding the connection between face value and coupon rate empowers investors to make informed decisions. For instance, investors seeking higher current income may prefer bonds with lower face values and higher coupon rates. Alternatively, investors with a longer investment horizon may opt for bonds with higher face values and lower coupon rates, anticipating capital appreciation closer to maturity when the face value is repaid.

By comprehending the relationship between face value and coupon rate, investors can effectively evaluate and compare different bonds, align their investment strategies with their financial goals, and maximize their returns.

Interest Payments

Interest payments lie at the heart of bond valuation and are an integral component of calculating a bond’s coupon rate. These payments represent the periodic interest paid to bondholders by the bond issuer, typically on a semi-annual basis. Understanding the connection between interest payments and coupon rate calculation is fundamental for investors seeking to evaluate and compare bonds effectively.

The coupon rate, expressed as a percentage, is directly derived from the annual interest payments. The formula for calculating the coupon rate is: Coupon Rate = (Interest Payment / Face Value) * 100%. This formula highlights the proportional relationship between interest payments and coupon rate; higher interest payments lead to a higher coupon rate, and vice versa.

In practice, interest payments play a critical role in determining the attractiveness of a bond investment. Bonds with higher coupon rates offer investors a higher current income, making them appealing to those seeking regular cash flow. However, it’s important to note that a higher coupon rate may come at the expense of capital appreciation, as investors may be paying a premium for the higher current income. Conversely, bonds with lower coupon rates may offer a lower current income but have the potential for higher capital appreciation over time, particularly in a rising interest rate environment.

Understanding the relationship between interest payments and coupon rate calculation empowers investors to make informed decisions based on their individual investment goals and risk tolerance. By considering both the current income and potential capital appreciation aspects, investors can select bonds that align with their financial objectives and optimize their portfolio returns.

Bond Price

Bond price is a critical component in calculating the coupon rate of a bond. The coupon rate, a fixed percentage representing the annual interest payments made to bondholders, is directly related to the bond’s price. Understanding this relationship is essential for investors seeking to evaluate and compare bonds effectively.

The bond price and coupon rate exhibit an inverse relationship. When the bond price increases, the coupon rate decreases, and vice versa. This inverse relationship stems from the fact that the total annual interest payment remains constant regardless of the bond price. As such, a higher bond price means that the same interest payment is spread over a larger principal amount, resulting in a lower coupon rate. Conversely, a lower bond price concentrates the interest payment on a smaller principal amount, leading to a higher coupon rate.

In real-world scenarios, understanding the connection between bond price and coupon rate calculation empowers investors to make informed decisions. For instance, investors seeking higher current income may prefer bonds trading at a discount (below face value), as these bonds typically offer higher coupon rates. Alternatively, investors with a longer investment horizon may opt for bonds trading at a premium (above face value), anticipating capital appreciation closer to maturity when the bond price converges to its face value.

By comprehending the relationship between bond price and coupon rate calculation, investors can effectively evaluate and compare different bonds, align their investment strategies with their financial goals, and optimize their returns.

Yield to Maturity

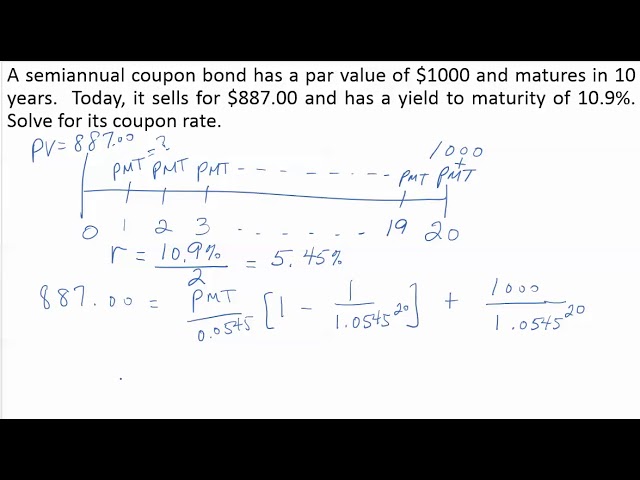

Yield to Maturity (YTM) is a significant concept intertwined with the calculation of a bond’s coupon rate. It represents the annualized rate of return an investor can expect to receive if they hold the bond until its maturity date. Understanding YTM is crucial for evaluating and comparing bonds, enabling investors to make informed decisions.

- Present Value of Future Cash Flows: YTM considers the present value of all future cash flows from a bond, including coupon payments and the repayment of the principal at maturity.

- Time to Maturity: The time remaining until the bond’s maturity date significantly impacts YTM. Bonds with longer maturities generally have higher YTMs due to the increased uncertainty and risk involved.

- Market Interest Rates: YTM is influenced by prevailing market interest rates. When interest rates rise, bond prices typically fall, resulting in higher YTMs. Conversely, when interest rates fall, bond prices tend to rise, leading to lower YTMs.

- Creditworthiness of the Issuer: The creditworthiness of the bond issuer can affect YTM. Bonds issued by higher-rated issuers typically have lower YTMs due to their perceived lower risk of default.

By understanding the relationship between YTM and the various factors that influence it, investors can better assess the attractiveness of bonds and align their investment strategies with their risk tolerance and financial goals.

Bond Rating

Bond rating is an integral aspect of understanding how to calculate a bond’s coupon rate. It serves as a crucial indicator of the creditworthiness of the bond issuer, providing insights into the level of risk associated with the investment. By assessing bond ratings, investors can make informed decisions about the suitability of bonds for their portfolios.

- Creditworthiness: Bond rating agencies evaluate the financial health and ability of the issuer to meet its debt obligations. Higher ratings indicate a lower risk of default, while lower ratings suggest a higher risk.

- Interest Rate Sensitivity: Bonds with lower ratings are more sensitive to changes in interest rates, as investors demand higher returns to compensate for the increased risk. This sensitivity can impact the calculation of the coupon rate.

- Investment-Grade vs. Non-Investment-Grade: Bonds are typically classified as investment-grade or non-investment-grade (also known as high-yield). Investment-grade bonds have higher ratings and lower risk, while non-investment-grade bonds have lower ratings and higher risk.

- Impact on Coupon Rate: Bond issuers with higher ratings can typically borrow at lower interest rates, resulting in lower coupon rates. Conversely, issuers with lower ratings may need to offer higher coupon rates to attract investors.

In summary, understanding bond ratings is crucial for calculating coupon rates accurately. By considering the creditworthiness of the issuer, interest rate sensitivity, and investment-grade classification, investors can gain valuable insights into the risk and return associated with a bond investment.

Historical Rates

Historical rates play a significant role in calculating coupon rates of bonds. By examining past interest rate trends and coupon rates, investors can gain insights into current and future market conditions, enabling them to make informed investment decisions.

- Past Coupon Rates: Analyzing historical coupon rates of similar bonds can provide a benchmark for assessing the current coupon rate. Higher historical coupon rates may indicate a higher risk associated with the issuer or the industry, leading to a higher current coupon rate.

- Interest Rate Trends: Understanding historical interest rate trends is crucial as coupon rates are influenced by market interest rates. Rising interest rates typically lead to lower bond prices and higher coupon rates, while falling interest rates have the opposite effect.

- Economic Conditions: Historical economic conditions can influence coupon rates. Strong economic growth and low inflation tend to result in lower coupon rates, while economic downturns and high inflation can lead to higher coupon rates.

- Default Rates: Examining historical default rates of bonds with similar characteristics can provide insights into the risk associated with the issuer. Higher default rates may indicate a higher likelihood of future defaults, potentially leading to higher coupon rates.

By incorporating historical rates into their analysis, investors can gain a more comprehensive understanding of the factors that influence coupon rates, enabling them to make informed decisions and optimize their bond investments.

Market Conditions

Market conditions play a crucial role in determining coupon rates of bonds. Understanding these conditions and their impact is essential for accurate coupon rate calculation and informed investment decisions.

- Economic Growth: Strong economic growth typically leads to higher demand for bonds, resulting in lower coupon rates. Conversely, slow economic growth can lead to higher coupon rates as investors seek higher returns.

- Inflation: Rising inflation erodes the value of fixed income payments, making bonds less attractive to investors. As a result, coupon rates tend to increase during periods of high inflation.

- Interest Rate Environment: The prevailing interest rate environment significantly influences coupon rates. When interest rates rise, bond prices fall and coupon rates increase. Conversely, when interest rates fall, bond prices rise and coupon rates decrease.

- Supply and Demand: The supply and demand dynamics in the bond market affect coupon rates. When there is a high supply of bonds relative to demand, coupon rates tend to be lower. Conversely, when there is a high demand for bonds relative to supply, coupon rates tend to be higher.

By considering market conditions, investors can gain insights into the factors that drive coupon rates and make more informed decisions. This understanding enables them to assess the attractiveness of bonds and align their investment strategies with their risk tolerance and financial goals.

Frequently Asked Questions on Calculating Coupon Rate of a Bond

This section addresses common questions and concerns regarding the calculation of coupon rates on bonds. These FAQs aim to clarify key concepts and provide additional insights for better understanding.

Question 1: What is the formula for calculating coupon rate?

The coupon rate is calculated as (Annual Interest Payment / Face Value) * 100%. It represents the annual interest payment as a percentage of the face value.

Question 2: How does face value affect coupon rate?

Face value and coupon rate are inversely related. A higher face value leads to a lower coupon rate, while a lower face value results in a higher coupon rate.

Question 3: What role do interest payments play in calculating coupon rate?

Interest payments are directly proportional to coupon rate. Higher interest payments result in a higher coupon rate, and vice versa.

Question 4: How is bond price related to coupon rate?

Bond price and coupon rate exhibit an inverse relationship. When bond price increases, coupon rate decreases, and vice versa.

Question 5: Can you explain the impact of time to maturity on coupon rate?

Time to maturity affects the calculation of yield to maturity (YTM), which is closely related to coupon rate. Generally, bonds with longer maturities have higher YTMs and, thus, higher coupon rates.

Question 6: How can investors use historical coupon rates?

Examining historical coupon rates can provide insights into market conditions and issuer creditworthiness. This information can be used to assess the attractiveness of current coupon rates and make informed investment decisions.

These FAQs provide a concise overview of key aspects related to calculating coupon rates on bonds. By understanding these concepts, investors can better evaluate and compare bonds, make informed decisions, and optimize their fixed income investments.

In the next section, we will delve deeper into the relationship between coupon rates and bond valuation, exploring how coupon rates influence bond prices and investment strategies.

Tips for Calculating Coupon Rate of a Bond

Understanding the calculation of coupon rates is crucial for bond investors. This section provides actionable tips to assist in accurate calculation and informed decision-making.

Tip 1: Determine the Face Value: Identify the principal amount borrowed by the bond issuer, which serves as the base for interest payments and coupon rate calculation.

Tip 2: Calculate Annual Interest Payments: Determine the fixed interest payments made to bondholders annually. These payments are typically expressed as a percentage of the face value.

Tip 3: Apply the Formula: Utilize the formula Coupon Rate = (Annual Interest Payment / Face Value) * 100% to calculate the coupon rate as a percentage.

Tip 4: Consider Market Conditions: Understand how prevailing economic conditions, interest rate environment, and supply and demand dynamics influence coupon rates.

Tip 5: Analyze Historical Rates: Examine past coupon rates of similar bonds to gauge current market conditions and assess the reasonableness of the calculated coupon rate.

Tip 6: Assess Bond Rating: Evaluate the creditworthiness of the bond issuer through bond ratings. Higher ratings generally indicate lower risk and potentially lower coupon rates.

Tip 7: Calculate Yield to Maturity: Consider yield to maturity (YTM) to determine the annualized rate of return on a bond held until maturity. YTM is influenced by coupon rate and other factors.

Tip 8: Compare and Evaluate: Compare coupon rates of different bonds to assess their relative attractiveness. Consider factors such as risk tolerance, investment horizon, and financial goals.

By following these tips, investors can accurately calculate coupon rates, gain insights into bond valuation, and make informed investment decisions.

The next section will explore the relationship between coupon rates and bond pricing, providing further insights into bond valuation and investment strategies.

Conclusion

This article has delved into the intricacies of calculating coupon rates on bonds, providing valuable insights for investors seeking to evaluate and compare bonds effectively. By understanding the formula, considering market conditions, and analyzing historical rates, investors can accurately determine coupon rates and make informed investment decisions.

Key takeaways include the inverse relationship between coupon rate and bond price, the influence of interest payments and face value on coupon rate calculation, and the impact of bond ratings on the perceived risk and resulting coupon rate. These interconnected concepts provide a comprehensive understanding of coupon rate calculation and its implications for bond valuation.