Calculating Trade Discounts: A Comprehensive Guide for Business Owners

Calculating a trade discount involves deducting a percentage from a pre-determined list price. For instance, a 20% trade discount on a $100 product would reduce the price for a buyer to $80.

Understanding trade discounts is essential for business owners to optimize their pricing strategies, manage inventory effectively, and maintain healthy profit margins. Historically, trade discounts have been used to incentivize bulk purchases and establish long-term business partnerships.

In this article, we will delve into the intricate details of calculating trade discounts, exploring various methods, common terminologies, and practical applications. We will also provide real-world examples and industry best practices to help business owners make informed decisions about trade discounts in their operations.

How to Calculate a Trade Discount

Calculating trade discounts involves understanding crucial aspects related to pricing strategies, inventory management, and profit optimization. Here are 9 key aspects to consider:

- Discount Percentage

- List Price

- Net Price

- Invoice Amount

- Trade Discount Rate

- Complementary Discount

- Quantity Discount

- Seasonal Discount

- Cash Discount

These aspects are interconnected and play a vital role in determining the final price paid by the customer. A thorough understanding of these aspects enables businesses to make informed decisions, optimize pricing, and enhance profitability.

Discount Percentage

Discount Percentage plays a pivotal role in calculating trade discounts, directly influencing the final price paid by the customer. It represents the percentage reduction applied to the list price, determining the amount of savings for the buyer. A higher Discount Percentage translates to a lower Net Price, making the product or service more affordable.

Understanding the relationship between Discount Percentage and trade discounts is crucial for businesses. By adjusting the Discount Percentage, companies can tailor their pricing strategies to specific market segments, promote seasonal sales, or incentivize bulk purchases. For instance, a clothing retailer might offer a 20% Discount Percentage during end-of-season sales to clear out inventory, while a software company could provide a 50% Discount Percentage on bulk purchases to encourage larger orders.

Calculating trade discounts with Discount Percentage involves a straightforward formula: Net Price = List Price – (Discount Percentage * List Price). By knowing the Discount Percentage and the List Price, businesses can quickly determine the discounted price for their customers. This calculation is essential for accurate invoicing, inventory management, and profit analysis.

List Price

List Price, also known as the Manufacturer’s Suggested Retail Price (MSRP), serves as a crucial foundation for calculating trade discounts. It represents the standard price of a product or service before any discounts or adjustments are applied.

Understanding the relationship between List Price and trade discounts is essential because it directly influences the Net Price paid by the customer. A higher List Price will result in a larger discount amount when a trade discount percentage is applied. This relationship empowers businesses to adjust their pricing strategies based on market conditions, target customer segments, and competitive dynamics.

For instance, a furniture retailer might set a List Price of $1000 for a couch. If they offer a 20% trade discount to a customer, the Net Price would be $800. This discounted price can serve as an incentive for the customer to make a purchase, while still allowing the retailer to maintain a profitable margin.

In conclusion, List Price plays a pivotal role in calculating trade discounts. By understanding this relationship, businesses can optimize their pricing strategies, enhance their competitiveness, and maximize their profitability.

Net Price

Net Price, often referred to as the discounted price, is a crucial component in understanding how to calculate a trade discount. It represents the final price paid by the customer after the deduction of trade discounts from the List Price.

The relationship between Net Price and trade discounts is inversely proportional. A higher trade discount percentage directly translates to a lower Net Price. This relationship empowers businesses to adjust their pricing strategies to align with market demand, customer segments, and competitive dynamics.

For instance, consider a clothing retailer offering a 20% trade discount on a dress with a List Price of $100. Applying the discount, the Net Price for the customer becomes $80. This discounted price serves as an incentive for the customer to make a purchase while allowing the retailer to maintain profitability.

Understanding the connection between Net Price and trade discounts is essential for businesses to optimize their pricing, enhance competitiveness, and maximize profitability. By leveraging this knowledge, companies can effectively manage inventory, plan sales promotions, and negotiate favorable terms with suppliers and customers.

Invoice Amount

In the realm of calculating trade discounts, Invoice Amount plays a pivotal role, serving as the foundation upon which discounts are applied. It represents the total monetary value of a transaction before any deductions or adjustments.

- Subtotal: The sum of all individual item prices before any discounts or taxes are applied.

- Trade Discounts: The total amount deducted from the Subtotal based on negotiated trade discount percentages.

- Shipping and Handling: Additional charges incurred for delivering the goods to the customer.

- Taxes: Applicable taxes, such as sales tax or value-added tax, levied on the Subtotal or Net Price.

Understanding Invoice Amount is crucial for businesses to accurately calculate trade discounts, optimize pricing strategies, and maintain healthy profit margins. By considering the various components and implications of Invoice Amount, businesses can effectively manage their financial operations, build strong customer relationships, and navigate the complexities of trade discount calculations.

Trade Discount Rate

Trade Discount Rate, an essential aspect of calculating trade discounts, represents the percentage reduction applied to the List Price of goods or services. It plays a crucial role in determining the Net Price paid by the customer and is expressed as a percentage, ranging from 0% (no discount) to 100% (completely free).

- Tiered Discounts: Trade Discount Rates can be structured in tiers, offering different discounts based on purchase quantity or customer loyalty.

- Complementary Discounts: Businesses may offer additional Trade Discount Rates on top of existing discounts, such as seasonal promotions or cash discounts for early payment.

- Industry Standards: Trade Discount Rates vary across industries and product categories, influenced by factors such as market competition and supplier-customer relationships.

- Negotiation and Relationship: Trade Discount Rates are often negotiated between buyers and sellers, considering factors such as order size, payment terms, and the strength of their business relationship.

Understanding Trade Discount Rate is crucial for businesses to optimize their pricing strategies, build strong supplier relationships, and maximize profitability. By carefully considering the various facets of Trade Discount Rate, businesses can make informed decisions about discounts, ensuring a balance between customer satisfaction and financial goals.

Complementary Discount

Complementary Discount is a type of trade discount offered alongside other discounts, enhancing the overall discount rate and further reducing the Net Price paid by the customer. It’s a valuable tool for businesses to incentivize purchases, build customer loyalty, and manage inventory effectively.

- Tiered Discounts: Complementary Discounts can be structured in tiers, offering progressive discount rates based on purchase quantity or customer loyalty. For example, a clothing store might offer an additional 5% discount on top of a base 10% trade discount for customers who purchase over $100 worth of merchandise.

- Seasonal Promotions: Businesses may offer Complementary Discounts during specific seasons or holidays to boost sales and clear inventory. For instance, an electronics retailer might provide an extra 15% off on laptops during the back-to-school season.

- Early Payment Discounts: Complementary Discounts can be offered as an incentive for early payment of invoices. This encourages customers to settle their accounts promptly, improving cash flow for the business.

- Volume Discounts:Businesses may offer Complementary Discounts for bulk purchases, rewarding customers who order larger quantities. This encourages customers to purchase more significant amounts, streamlining inventory management for the business.

Understanding Complementary Discount is crucial for businesses to optimize pricing strategies, enhance customer relationships, and maximize profitability. By leveraging Complementary Discounts effectively, businesses can create a win-win situation for both themselves and their customers, fostering long-term partnerships and driving sales growth.

Quantity Discount

Quantity Discount, an integral part of trade discount calculations, plays a vital role in incentivizing bulk purchases and managing inventory. It involves offering reduced pricing for customers who purchase larger quantities of goods or services.

- Tiered Discounts: Businesses may implement tiered quantity discounts, offering progressively higher discounts as the purchase quantity increases. This encourages customers to buy larger volumes, streamlining inventory management and reducing storage costs.

- Cumulative Discounts: Quantity discounts can be cumulative, meaning that the discount rate increases with each additional unit purchased. This encourages customers to consolidate their purchases with a single supplier, building stronger supplier-customer relationships.

- Threshold Discounts: Businesses may offer quantity discounts only when a specific purchase threshold is met. This encourages customers to increase their order size to qualify for the discount, boosting sales and optimizing inventory levels.

- Assortment Discounts: Quantity discounts can be applied to a combination of different products or services, incentivizing customers to purchase a wider range of items. This helps businesses clear slow-moving inventory and promote cross-selling.

Understanding Quantity Discount and its various facets is crucial for businesses to optimize pricing strategies, enhance customer relationships, and maximize profitability. By leveraging Quantity Discounts effectively, businesses can encourage bulk purchases, reduce inventory costs, and foster long-term partnerships with their customers.

Seasonal Discount

Seasonal Discount refers to a price reduction strategy commonly used by businesses to promote sales during specific seasons or holidays. It plays a significant role in the calculation of trade discounts, influencing the Net Price paid by customers and the overall profitability of a business.

- Holiday Discounts: Businesses often offer Seasonal Discounts during major holidays such as Christmas, Thanksgiving, or Easter. These discounts incentivize customers to make purchases related to the festive occasion, boosting sales and clearing inventory.

- End-of-Season Sales: To make way for new inventory, businesses may offer Seasonal Discounts towards the end of a season. These discounts help liquidate slow-moving items and make space for upcoming products.

- Back-to-School Promotions: Many businesses offer Seasonal Discounts during the back-to-school season to cater to students and parents purchasing school supplies, clothing, and electronics.

- Clearance Events: Seasonal Discounts can be used to clear out excess inventory or discontinued items. These discounts are typically deeper than regular promotions and can help businesses free up storage space and generate additional revenue.

Understanding Seasonal Discount and its various facets is crucial for businesses to optimize pricing strategies, manage inventory effectively, and maximize profitability. By leveraging Seasonal Discounts strategically, businesses can align their sales with seasonal demand, increase customer traffic, and enhance overall financial performance.

Cash Discount

Cash Discount, often referred to as a prompt payment discount or settlement discount, is an essential component in understanding how to calculate a trade discount. It represents a price reduction offered to customers who pay their invoices within a specified time frame, typically ranging from 7 to 30 days.

The connection between Cash Discount and trade discount calculation lies in the fact that Cash Discount is applied before calculating the trade discount. This means that the Net Price, which serves as the basis for trade discount calculations, is reduced by the Cash Discount amount. As a result, the final price paid by the customer is lower compared to scenarios where no Cash Discount is offered.

For instance, consider a scenario where a customer purchases goods with a List Price of $100. If the supplier offers a trade discount of 10% and a Cash Discount of 2% for payments made within 10 days, the calculation would proceed as follows:

- Net Price without Cash Discount: $100 – (10% $100) = $90

- Net Price with Cash Discount: $90 – (2% $90) = $88.20

In this example, the customer saves $1.80 by taking advantage of the Cash Discount. This demonstrates the practical significance of understanding the connection between Cash Discount and trade discount calculation, as businesses can leverage it to incentivize timely payments and improve their cash flow.

Frequently Asked Questions (FAQs) on Calculating Trade Discounts

This section addresses commonly asked questions and clarifies various aspects related to calculating trade discounts, providing comprehensive guidance to readers.

Question 1: What is the formula for calculating a trade discount?

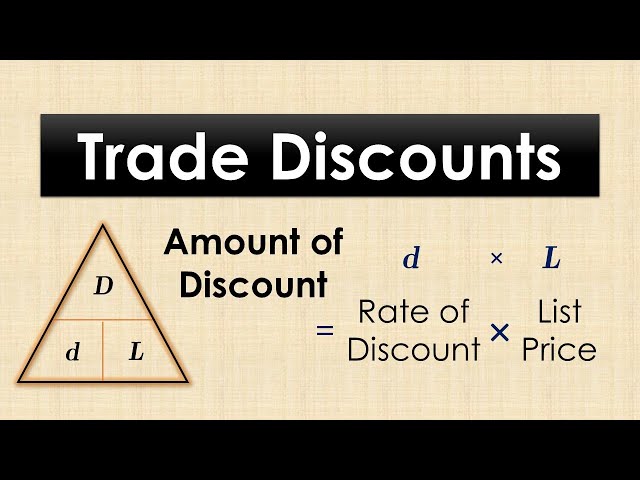

Answer: To calculate the trade discount, use the formula: Trade Discount = List Price x Discount Rate. The Discount Rate is expressed as a decimal, representing the percentage discount offered.

Question 2: How does a trade discount affect the Net Price?

Answer: A trade discount reduces the List Price, resulting in a lower Net Price for the customer. The Net Price is calculated as: Net Price = List Price – Trade Discount.

Question 3: What is the difference between a trade discount and a cash discount?

Answer: A trade discount is offered based on factors such as purchase quantity or customer loyalty, while a cash discount is an incentive for prompt payment. Cash discounts are typically calculated as a percentage of the Net Price.

Question 4: How can businesses use trade discounts effectively?

Answer: Businesses can leverage trade discounts to boost sales, attract new customers, manage inventory, and enhance customer relationships. They can also use trade discounts to compete with rivals and differentiate their offerings.

Question 5: Are there different types of trade discounts?

Answer: Yes, there are various types of trade discounts, including quantity discounts, seasonal discounts, and complementary discounts. Each type serves a specific purpose and can be tailored to different business needs.

Question 6: How can I negotiate favorable trade discounts?

Answer: To negotiate favorable trade discounts, businesses should establish strong supplier relationships, demonstrate consistent purchasing patterns, and understand industry benchmarks. They should also be prepared to discuss their business needs and explore mutually beneficial arrangements.

In summary, calculating trade discounts involves understanding key concepts such as List Price, Net Price, and Discount Rate. By leveraging trade discounts strategically, businesses can optimize their pricing, enhance customer satisfaction, and achieve greater profitability.

In the next section, we will delve deeper into advanced techniques for calculating trade discounts, exploring scenarios with multiple discounts and complex pricing structures.

Tips for Calculating Trade Discounts

This section provides practical tips to help businesses accurately calculate trade discounts and optimize their pricing strategies.

Tip 1: Determine the List Price: Establish the original price of the product or service before any discounts are applied. This serves as the basis for all trade discount calculations.

Tip 2: Calculate the Trade Discount Rate: Determine the percentage discount offered to the customer, typically expressed as a decimal. This rate is used to reduce the List Price and arrive at the Net Price.

Tip 3: Apply Trade Discounts Sequentially: If multiple trade discounts apply (e.g., quantity discount and seasonal discount), apply them sequentially. Calculate the Net Price after each discount to ensure accurate pricing.

Tip 4: Consider Cash Discounts: If a business offers a cash discount for prompt payment, deduct it from the Net Price before applying any other trade discounts.

Tip 5: Negotiate Favorable Terms: Establish strong relationships with suppliers and negotiate favorable trade discounts based on factors such as purchase volume, payment terms, and industry benchmarks.

Tip 6: Use Discount Matrices: For complex pricing structures with multiple discount scenarios, create discount matrices to streamline calculations and avoid errors.

Tip 7: Utilize Technology: Leverage accounting software or online tools to automate trade discount calculations, ensuring accuracy and efficiency.

Tip 8: Monitor and Review: Regularly review trade discount strategies to assess their effectiveness and make adjustments as needed to optimize pricing and profitability.

By following these tips, businesses can enhance their understanding of trade discount calculations, optimize pricing, and improve their overall financial performance.

In the concluding section, we will explore advanced trade discount strategies and discuss how to leverage them for competitive advantage and customer satisfaction.

Conclusion

In summary, understanding how to calculate trade discounts empowers businesses to optimize pricing strategies, manage inventory effectively, strengthen supplier relationships, and enhance profitability. Key takeaways from this article include:

- Trade discounts involve reducing the List Price of goods or services based on factors such as purchase quantity, customer loyalty, and seasonal promotions.

- Businesses can leverage trade discounts to incentivize purchases, clear inventory, and differentiate their offerings in the market.

- Accurately calculating trade discounts requires careful consideration of List Price, Discount Rate, and the sequential application of multiple discounts.

By mastering the art of trade discount calculation, businesses can unlock a powerful tool for driving sales growth, fostering customer loyalty, and achieving long-term financial success. It is an essential skill for any business seeking to optimize its pricing and gain a competitive edge in today’s dynamic marketplace.