How to Calculate the Trade Discount refers to the process of determining the reduced price given to a customer or business purchasing goods or services in bulk quantities.

Trade discounts are crucial in various industries, offering benefits such as increased sales volume, customer loyalty, and cost savings. One significant historical development was the introduction of standard discount terms in the 1930s, enhancing communication and trust in business transactions.

In this article, we will delve into the methods for calculating trade discounts, providing step-by-step instructions, real-world examples, and insights into the factors influencing discount rates.

How to Calculate the Trade Discount

Accurate calculation of trade discounts is crucial for businesses to optimize pricing strategies, manage cash flow, and build strong customer relationships. Key aspects to consider include:

- Discount rate

- Base price

- Net price

- Invoice amount

- Quantity purchased

- Payment terms

- Industry benchmarks

- Customer loyalty

- Market conditions

Understanding these aspects allows businesses to tailor discount structures that meet their specific objectives. For instance, offering higher discounts for bulk purchases incentivizes customers to buy in larger quantities, potentially increasing sales volume and reducing storage costs. Additionally, trade discounts can be used to reward loyal customers, strengthen relationships, and encourage repeat business.

Discount rate

The discount rate is a crucial aspect to consider when calculating trade discounts, as it determines the amount of reduction offered to customers. Several factors influence the discount rate, including:

- Industry benchmarks: Different industries have established norms for trade discounts, providing a reference point for businesses to set their own rates.

- Customer loyalty: Businesses may offer higher discounts to loyal customers as a reward for their continued patronage.

- Quantity purchased: Bulk purchases often qualify for greater discounts, incentivizing customers to buy in larger quantities.

- Payment terms: Businesses may offer discounts for early payment or for using specific payment methods.

By carefully considering these factors, businesses can establish discount rates that balance their profit margins with the need to attract and retain customers.

Base price

The base price, also known as the list price or sticker price, serves as a critical foundation for calculating trade discounts. It represents the manufacturer’s suggested retail price (MSRP) or the standard price of a product or service before any discounts or markups are applied.

In the context of trade discounts, the base price plays a pivotal role. The discount rate, expressed as a percentage, is applied to the base price to determine the amount of reduction offered to customers. A higher base price will result in a larger absolute discount, while a lower base price will yield a smaller discount. Therefore, businesses must carefully consider the base price when setting discount rates to ensure profitability and customer satisfaction.

For instance, suppose a product has a base price of $100 and a trade discount of 20% is offered. The discount amount would be $20, resulting in a net price of $80 for the customer. Conversely, if the base price were $75, the same 20% discount would result in a discount of $15 and a net price of $60. This demonstrates the direct relationship between base price and trade discount calculation.

Understanding the connection between base price and trade discount is crucial for businesses to optimize pricing strategies, manage cash flow, and build strong customer relationships. By carefully considering both factors, businesses can establish pricing structures that meet their specific objectives and drive business growth.

Net price

Net price holds a critical position in the calculation of trade discounts, establishing the foundation upon which discounts are applied. It represents the final price of a product or service after deducting all applicable discounts, including trade discounts, from the base price. Understanding the relationship between net price and trade discount calculation is crucial for businesses to optimize pricing strategies and build strong customer relationships.

The trade discount, expressed as a percentage, is directly applied to the base price to determine the amount of reduction offered to customers. This discount is then subtracted from the base price to arrive at the net price. For instance, consider a product with a base price of $100 and a trade discount of 20%. The discount amount would be $20, resulting in a net price of $80 for the customer. This demonstrates how trade discounts directly impact the net price paid by customers.

In practical applications, businesses leverage trade discounts to incentivize bulk purchases, reward customer loyalty, and clear out excess inventory. By offering discounts, businesses can increase sales volume, generate cash flow, and enhance customer satisfaction. Understanding the cause-and-effect relationship between trade discounts and net price empowers businesses to make informed decisions regarding pricing and discount structures, ultimately driving business growth and profitability.

Invoice amount

Invoice amount plays a pivotal role in the calculation of trade discounts, serving as the basis from which discounts are applied. Understanding how invoice amount influences trade discount calculation is crucial for businesses to optimize pricing strategies and manage cash flow effectively.

- Subtotal: Represents the total cost of goods or services before any discounts or taxes are applied.

- Trade discounts: Deductions from the subtotal, expressed as a percentage or fixed amount, offered to customers based on factors such as bulk purchases or loyalty.

- Taxes: Applicable taxes, such as sales tax or value-added tax (VAT), added to the net price (subtotal minus trade discounts).

- Shipping and handling charges: Additional costs associated with delivering the goods or services to the customer.

By understanding the components of invoice amount and their relationship to trade discounts, businesses can tailor pricing structures that meet their specific objectives, build strong customer relationships, and maximize profitability. Trade discounts can incentivize bulk purchases, reward customer loyalty, and clear out excess inventory, all of which can contribute to increased sales volume, improved cash flow, and enhanced customer satisfaction.

Quantity purchased

In the realm of trade discounts, “Quantity purchased” emerges as a pivotal factor that significantly influences discount calculation and plays a substantial role in shaping pricing strategies. This aspect encompasses various components and dimensions, each of which warrants careful examination.

- Bulk purchases: Buying larger quantities often qualifies customers for more substantial discounts, a strategy commonly employed to encourage increased sales volume and clear out excess inventory.

- Tiered discounts: Some businesses implement a tiered discount structure, offering progressively higher discounts for each incremental quantity purchased, incentivizing larger orders and fostering customer loyalty.

- Minimum order quantity: Setting a minimum order quantity can encourage customers to purchase more to qualify for discounts, boosting sales and optimizing inventory management.

- Exclusive discounts for large orders: Certain businesses reserve exclusive discounts for customers placing exceptionally large orders, recognizing the value of bulk purchases and rewarding customer commitment.

In essence, “Quantity purchased” serves as a strategic lever for businesses to incentivize desired purchasing behavior, manage inventory levels, and enhance customer relationships. Understanding the intricacies of this aspect empowers businesses to tailor discount structures that align with their objectives, drive sales growth, and build lasting partnerships with customers.

Payment terms

Payment terms are inextricably linked to the calculation of trade discounts and play a critical role in shaping pricing strategies and cash flow management. They define the conditions under which customers are expected to settle their invoices, including the time frame and method of payment. Understanding the relationship between payment terms and trade discounts is crucial for businesses to optimize their financial operations and build strong customer relationships.

Businesses often offer trade discounts to incentivize early payments or purchases using specific payment methods. For instance, a business may offer a 2% discount for payments made within 10 days of the invoice date or a 3% discount for payments made via online platforms. These discounts can significantly impact cash flow, as they encourage customers to settle their invoices promptly, reducing the risk of late payments and bad debts.

Conversely, businesses may impose additional charges or penalties for late payments. Late payment fees or interest charges can offset the benefits of trade discounts, making it essential for businesses to clearly communicate their payment terms and consequences to customers. By establishing clear expectations and aligning payment terms with business objectives, businesses can effectively manage cash flow and maintain healthy financial relationships with their customers.

Industry benchmarks

In the context of trade discount calculation, industry benchmarks serve as valuable references that guide businesses in determining appropriate discount rates and structures. These benchmarks are established norms and standards within specific industries, providing a foundation for businesses to set their own discount policies while maintaining competitiveness and customer satisfaction.

- Established norms: Trade associations and industry leaders often publish recommended discount rates based on historical data and market trends. These established norms provide a starting point for businesses to develop their own discount structures.

- Competitive analysis: Businesses can analyze the discount rates offered by their competitors to gain insights into industry practices and customer expectations. This information helps them position their own discounts competitively while differentiating their offerings.

- Customer expectations: Understanding customer expectations for trade discounts is crucial. Industry benchmarks can provide guidance on the range of discounts typically offered for different product categories, quantities, and payment terms.

- Market conditions: Economic conditions, supply and demand dynamics, and seasonal factors can influence industry benchmarks. Businesses need to consider these factors when setting their discount rates to align with market trends.

By leveraging industry benchmarks, businesses can establish trade discount structures that are competitive, customer-centric, and aligned with market conditions. These benchmarks help ensure fair pricing, maintain industry standards, and foster healthy business relationships.

Customer loyalty

In the realm of trade discounts, customer loyalty plays a pivotal role in determining discount rates and structures. Loyal customers contribute to a business’s long-term success and stability, making it essential to foster and reward their continued patronage.

- Repeat purchases: Repeat purchases from loyal customers provide a predictable revenue stream and reduce customer acquisition costs.

- Positive word-of-mouth: Loyal customers often share positive experiences with others, generating valuable word-of-mouth marketing.

- Increased order value: Loyal customers tend to make larger and more frequent purchases, contributing to increased sales volume.

- Cost savings: Retaining loyal customers is generally more cost-effective than acquiring new ones.

To nurture customer loyalty, businesses can offer tiered discounts based on purchase history or implement loyalty programs that reward repeat business. By recognizing and rewarding loyal customers, businesses can strengthen relationships, increase customer lifetime value, and drive long-term growth.

Market conditions

When calculating trade discounts, businesses must consider the prevailing market conditions, which can significantly influence discount rates and strategies.

- Economic conditions: Economic booms and recessions impact consumer spending and business investment, affecting demand for goods and services and, consequently, trade discount rates.

- Supply and demand: Market forces of supply and demand influence trade discounts. When supply exceeds demand, businesses may offer higher discounts to stimulate sales, while in high-demand markets, discounts may be lower or non-existent.

- Competition: The level of competition in a market can affect trade discount practices. In highly competitive markets, businesses may offer larger discounts to gain market share, while in less competitive markets, discounts may be more conservative.

- Seasonality: Seasonal fluctuations in demand can impact trade discounts. Businesses may offer discounts during off-seasons to maintain sales volume and attract customers.

Understanding market conditions and their implications on trade discount calculation empowers businesses to adapt their pricing strategies, optimize cash flow, and maintain a competitive edge. By considering these factors, businesses can make informed decisions about discount rates that align with market dynamics and drive business success.

Frequently Asked Questions

This FAQ section provides concise answers to common questions and clarifies essential aspects of calculating trade discounts.

Question 1: What is a trade discount?

A trade discount is a reduction in the price of goods or services offered to specific customers, typically based on factors like bulk purchases or customer loyalty.

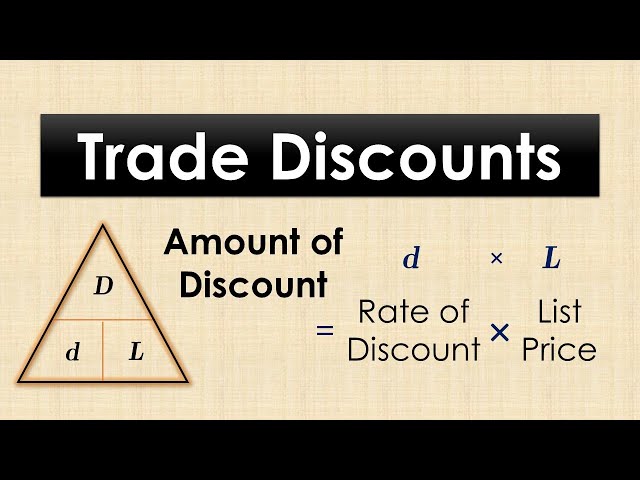

Question 2: How is a trade discount calculated?

To calculate a trade discount, multiply the base price of the item by the discount rate expressed as a decimal. The resulting amount represents the discount you can deduct from the base price.

Question 3: What is the difference between a trade discount and a cash discount?

A trade discount is offered based on factors such as purchase quantity or customer status, while a cash discount is offered for prompt payment within a specified period.

Question 4: Can trade discounts be negotiated?

In some cases, trade discounts can be negotiated with suppliers based on factors like order size, payment terms, and the customer’s bargaining power.

Question 5: How can I determine the best trade discount rate?

Consider factors like industry benchmarks, competitor pricing, customer loyalty, and market conditions to determine an appropriate trade discount rate.

Question 6: What are the benefits of offering trade discounts?

Trade discounts can increase sales volume, build customer loyalty, clear out excess inventory, and enhance cash flow.

These FAQs provide a solid foundation for understanding trade discount calculation. Further discussion will delve into specific strategies and best practices for optimizing trade discounts and maximizing their benefits.

Next Section: Optimizing Trade Discount Strategies

Tips for Optimizing Trade Discounts

Understanding the theory behind trade discount calculation is essential, but effective implementation requires practical strategies. Here are valuable tips to optimize your trade discount approach:

Analyze industry benchmarks: Research industry norms and competitor pricing to determine appropriate discount rates while maintaining competitiveness.

Segment customers effectively: Offer tailored discounts to different customer groups based on purchase history, loyalty, and industry.

Consider tiered discounts: Implement a tiered discount structure that rewards customers for increased purchase volume, encouraging bulk buying.

Negotiate with suppliers: Engage in negotiations with suppliers to secure better trade discount rates, especially for large or frequent orders.

Monitor market conditions: Stay informed about economic trends, supply and demand dynamics, and seasonality to adjust trade discounts accordingly.

Use trade discounts strategically: Offer trade discounts to incentivize specific purchasing behaviors, such as early payments or off-season purchases.

Communicate clearly: Ensure customers are aware of trade discount policies, including eligibility criteria, discount rates, and payment terms.

Track and evaluate: Regularly monitor the effectiveness of trade discount strategies and make adjustments as needed to maximize ROI.

Implementing these tips can enhance your trade discount optimization efforts, leading to increased sales, improved customer relationships, and optimized cash flow.

In the next section, we will explore best practices for managing trade discounts effectively, ensuring compliance, and mitigating risks.

Conclusion

Understanding the calculation of trade discounts is crucial for businesses to optimize pricing strategies, manage cash flow effectively, and build strong customer relationships. Key takeaways include the determination of discount rates based on factors like quantity purchased, payment terms, and customer loyalty; the application of these rates to the base price to determine the net price; and the consideration of industry benchmarks, market conditions, and customer segmentation to tailor discount structures.

By leveraging trade discounts strategically, businesses can incentivize bulk purchases, reward repeat customers, and clear out excess inventory. However, it’s essential to monitor the effectiveness of discount strategies, communicate policies clearly, and ensure compliance to maximize benefits and mitigate risks.