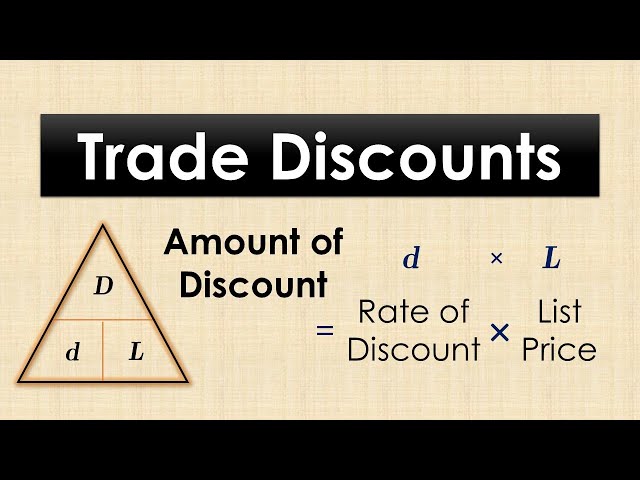

A trade discount is a reduction in the list price of a product or service offered to a specific group of buyers, such as wholesalers, retailers, or manufacturers. The trade discount formula is used to calculate the actual price that the buyer will pay after the discount has been applied. For example, if a product has a list price of $100 and a trade discount of 20%, the buyer will pay $80 for the product.

Trade discounts are important because they allow buyers to purchase products and services at a reduced price. This can help businesses save money on their operating costs and increase their profits. Trade discounts can also be used to encourage buyers to purchase larger quantities of products or services. Historically, trade discounts have been used for centuries to facilitate commerce and trade between businesses.

This article will provide a step-by-step guide on how to calculate the trade discount formula. We will also discuss the different types of trade discounts and the benefits of using them.

How to Calculate Trade Discount Formula

Understanding the key aspects of calculating trade discounts is essential for businesses to optimize their purchasing and pricing strategies. These aspects encompass various dimensions related to the formula, including:

- List price

- Trade discount rate

- Net price

- Discount amount

- Discount percentage

- Chain discounts

- Complementary discounts

- Seasonal discounts

- Quantity discounts

- Early payment discounts

These aspects are interconnected and play a crucial role in determining the actual price paid by the buyer. Businesses must carefully consider each aspect to ensure accurate calculations and maximize the benefits of trade discounts. Understanding the formula and its components empowers businesses to make informed decisions, optimize their cash flow, and enhance their profitability.

List price

The list price, also known as the sticker price, is the price of a product or service as determined by the seller or manufacturer. It is the price that is displayed on the product packaging or in the seller’s catalog. The list price is the basis for calculating trade discounts.

- Manufacturer’s Suggested Retail Price (MSRP)

The MSRP is the price that the manufacturer recommends that retailers sell the product for. It is often printed on the product packaging.

- Catalog price

The catalog price is the price that a seller lists in its catalog. It may be the same as the MSRP, but it may also be higher or lower.

The list price is an important factor to consider when calculating trade discounts. A higher list price will result in a higher trade discount. Conversely, a lower list price will result in a lower trade discount. Businesses must carefully consider the list price when negotiating trade discounts with their suppliers.

Trade discount rate

The trade discount rate is the percentage of the list price that is deducted to arrive at the net price. It is expressed as a percentage, such as 10%, 20%, or 30%. The trade discount rate is a critical component of the trade discount formula. It determines the amount of the discount that will be applied to the list price. A higher trade discount rate will result in a greater discount, while a lower trade discount rate will result in a smaller discount.

There are many factors that can affect the trade discount rate, including the type of product or service, the quantity purchased, the customer’s relationship with the seller, and the seller’s pricing strategy. Businesses must carefully consider all of these factors when negotiating trade discounts with their suppliers.

Real-life examples of trade discount rates can be found in a variety of industries. For example, a wholesaler may offer a trade discount of 20% to retailers who purchase large quantities of products. A manufacturer may offer a trade discount of 10% to distributors who sell their products to a wide range of customers. A service provider may offer a trade discount of 5% to customers who prepay for their services.

Understanding the connection between trade discount rate and the trade discount formula is essential for businesses that want to optimize their purchasing and pricing strategies. By carefully considering the trade discount rate, businesses can maximize their savings and improve their profitability.

Net price

The net price is the price of a product or service after the trade discount has been applied. It is the price that the buyer will actually pay. The net price is an important factor to consider when calculating the total cost of a purchase. A lower net price will result in a lower total cost.

- Amount after Discount

This refers to the monetary value deducted from the list price due to the application of the trade discount. It is calculated by multiplying the list price by the trade discount rate.

- Deductions and Rebates

Some trade discounts may include additional deductions or rebates, which further reduce the net price. These can be in the form of volume discounts, loyalty discounts, or seasonal promotions.

- Taxes and Shipping

It is important to note that the net price does not include taxes or shipping costs. These additional charges must be considered when calculating the total cost of the purchase.

- Cash Discounts

Some suppliers offer cash discounts for customers who pay their invoices early. These discounts can further reduce the net price and should be factored into the total cost calculation.

Understanding the net price and its components is essential for businesses that want to optimize their purchasing and pricing strategies. By carefully considering all of the factors that affect the net price, businesses can make informed decisions and maximize their savings.

Discount amount

The discount amount, often referred to as the trade discount, represents the monetary reduction applied to the list price of a product or service. This reduction is typically expressed as a percentage or a fixed amount and plays a significant role in determining the net price paid by the buyer. Calculating the discount amount accurately is crucial in optimizing purchasing and pricing strategies.

- Percentage Discount

A percentage discount is calculated by multiplying the list price by the discount rate expressed as a percentage. It results in a proportional reduction in the list price.

- Fixed Amount Discount

A fixed amount discount involves deducting a specific monetary value from the list price, regardless of its magnitude. This type of discount is often used for high-value items or bulk purchases.

- Cumulative Discount

A cumulative discount is applied when multiple discounts are offered sequentially. Each discount is calculated based on the discounted price of the previous discount, resulting in a greater overall reduction.

- Tiered Discount

A tiered discount offers different discount rates based on the quantity purchased. The more units purchased, the higher the discount rate applied.

Understanding the concept of discount amount empowers businesses to negotiate favorable terms with suppliers, optimize their purchasing costs, and enhance their profitability. By carefully considering the various types of discounts available and their implications, businesses can make informed decisions that maximize their savings and streamline their operations.

Discount percentage

Discount percentage, an integral component of calculating trade discounts, plays a pivotal role in determining the quantum of reduction in the list price of a product or service. It is expressed as a percentage and serves as a key factor in negotiating favorable terms and optimizing purchasing costs.

- Fixed Percentage Discount

A fixed percentage discount involves applying a predetermined percentage reduction to the list price, regardless of the quantity purchased. This simplified approach is commonly used in retail and e-commerce.

- Tiered Percentage Discount

A tiered percentage discount offers varying discount rates based on the quantity purchased. As the quantity increases, the applicable discount rate also increases. This strategy encourages bulk purchases and inventory stocking.

- Cumulative Percentage Discount

A cumulative percentage discount applies multiple discounts sequentially, resulting in a greater overall reduction. Each discount is calculated based on the discounted price of the previous discount, amplifying the savings.

- Negotiated Percentage Discount

A negotiated percentage discount is the result of discussions and bargaining between the buyer and seller. This approach allows for customized discounts based on factors such as order volume, payment terms, and loyalty.

Understanding these facets of discount percentage empowers businesses to effectively calculate trade discounts, optimize their purchasing strategies, and maximize their profitability. By carefully considering the various types of discounts available and their implications, businesses can make informed decisions that enhance their competitiveness and financial performance.

Chain discounts

Chain discounts are a pricing strategy used by manufacturers, suppliers, and distributors to offer a series of consecutive discounts on a product or service. Applied sequentially, these discounts multiply the overall discount received by the buyer. Understanding the concept and calculation of chain discounts is crucial for businesses aiming to optimize their purchasing costs.

- Calculating Chain Discounts

To calculate chain discounts, the discounts are applied one after another, starting with the list price. Each discount is expressed as a percentage and multiplied by the previous discounted price. The result is the new discounted price, on which the next discount is applied.

- Complementary Discounts

Chain discounts can be combined with other types of discounts, such as volume discounts or cash discounts, to further reduce the net price paid by the buyer. These complementary discounts provide additional savings opportunities when the conditions for both discounts are met.

- Negotiating Chain Discounts

The negotiation of chain discounts depends on several factors, including the buyer’s purchasing volume, the supplier’s pricing strategy, and the industry norms. Buyers can leverage their bargaining power to negotiate favorable chain discounts that align with their business objectives.

- Impact on Net Price

Chain discounts have a significant impact on the net price paid by the buyer. By multiplying multiple discounts, chain discounts can result in substantial overall savings. This cost reduction can improve the buyer’s profit margins or allow them to offer competitive prices to their customers.

In conclusion, chain discounts are a powerful pricing tool that can significantly reduce a product’s net price. By understanding the calculation, negotiation, and implications of chain discounts, businesses can optimize their purchasing strategies, maximize their savings, and gain a competitive advantage in the marketplace.

Complementary discounts

Complementary discounts play a significant role within the framework of calculating trade discounts. They represent an additional layer of savings that can be applied in conjunction with the standard trade discount formula. Understanding the connection between complementary discounts and the overall calculation process is crucial for businesses seeking to optimize their purchasing strategies.

Complementary discounts are offered by suppliers or manufacturers as a means of incentivizing bulk purchases, encouraging customer loyalty, or clearing out inventory. These discounts can take various forms, such as volume discounts, cash discounts, or seasonal promotions. By combining complementary discounts with the base trade discount, businesses can effectively reduce their overall procurement costs.

For instance, a supplier may offer a 10% trade discount on a product with an additional 5% volume discount for purchases exceeding a tertentu quantity. To calculate the net price using both discounts, the volume discount is applied first, followed by the trade discount. This approach yields a lower net price compared to applying a single discount.

Incorporating complementary discounts into the trade discount formula requires careful consideration of the terms and conditions associated with each discount. Businesses must evaluate the eligibility criteria, minimum purchase requirements, and any potential restrictions or limitations. By understanding these factors, businesses can maximize the benefits of complementary discounts and enhance their purchasing efficiency.

Seasonal discounts

In the context of calculating trade discounts, seasonal discounts play a significant role as a type of complementary discount. Understanding how seasonal discounts impact the trade discount formula is essential for businesses seeking to optimize their purchasing strategies and maximize savings.

- Periodicity

Seasonal discounts are offered for a limited duration during specific times of the year, typically aligned with seasonal demand patterns. This strategic approach allows businesses to clear out inventory, boost sales during off-seasons, and attract customers with attractive discounts.

- Product/Service Applicability

Seasonal discounts are often applied to products or services that experience fluctuating demand throughout the year. For instance, winter clothing may be discounted during the summer months, while air conditioners may be discounted during the winter months.

- Magnitude of Discounts

The magnitude of seasonal discounts can vary depending on factors such as the seasonality of the product, the level of competition, and the business’s overall pricing strategy. Discounts can range from modest percentages to significant reductions, offering substantial savings to customers.

- Customer Targeting

Businesses may tailor seasonal discounts to target specific customer segments. For instance, retailers may offer exclusive discounts to loyalty program members or senior citizens during the holiday season.

Integrating seasonal discounts into the trade discount formula requires careful evaluation of the discount terms and conditions, including the duration of the discount, eligible products or services, and any minimum purchase requirements. By leveraging seasonal discounts effectively, businesses can enhance their inventory management, boost sales during seasonal downturns, and attract new customers, ultimately contributing to increased profitability.

Quantity discounts

Quantity discounts, a crucial facet of trade discount calculations, offer reduced prices for customers purchasing larger quantities of products or services. They incentivize bulk purchases, streamline inventory management, and foster customer loyalty. Understanding the intricacies of quantity discounts is paramount for businesses seeking to optimize their purchasing and pricing strategies.

- Tiered Discounts

Tiered discounts provide varying discount rates based on the quantity purchased. As the quantity increases, the discount rate also increases, encouraging customers to purchase higher volumes to maximize savings.

- Volume Discounts

Volume discounts are offered to customers who commit to purchasing a specific quantity of products or services over a set period. These discounts are often negotiated and tailored to the specific needs and purchasing patterns of the customer.

- Cumulative Discounts

Cumulative discounts accumulate over multiple purchases, rewarding customers for their repeat business. Each subsequent purchase adds to the cumulative quantity, unlocking higher discount rates and greater savings.

- Early Order Discounts

Early order discounts incentivize customers to place orders in advance, providing them with reduced prices for early commitments. These discounts can help businesses secure orders, forecast demand, and optimize their production schedules.

The incorporation of quantity discounts into trade discount calculations requires careful consideration of the discount structure, eligibility criteria, and potential impact on cash flow. Businesses must evaluate the trade-off between offering attractive discounts to drive sales and maintaining profitability. By leveraging quantity discounts effectively, businesses can enhance customer satisfaction, boost sales, and strengthen their competitive advantage.

Early payment discounts

Early payment discounts, an essential facet of calculating trade discounts, offer incentives to customers who settle their invoices before the standard payment due date. By incorporating these discounts into the trade discount formula, businesses can enhance cash flow, strengthen customer relationships, and streamline their financial operations.

- Discount Rates

Early payment discounts are typically expressed as a percentage reduction from the net price. The discount rate varies depending on the industry, the supplier’s pricing strategy, and the length of the early payment period.

- Payment Terms

The payment terms specify the period within which the early payment discount can be availed. These terms are clearly outlined in the invoice or purchase order and may vary from supplier to supplier.

- Impact on Cash Flow

Early payment discounts provide businesses with an opportunity to improve their cash flow by encouraging customers to pay their invoices early. This can reduce the need for external financing and improve the business’s financial flexibility.

- Customer Relationships

Offering early payment discounts can foster positive customer relationships. Customers appreciate the incentive to pay early, and it can encourage repeat business and customer loyalty.

Incorporating early payment discounts into the trade discount formula requires careful consideration of the discount rate, payment terms, and potential impact on cash flow. By effectively leveraging early payment discounts, businesses can optimize their financial performance, strengthen customer relationships, and gain a competitive advantage.

FAQs about Calculating Trade Discount Formula

This section provides answers to frequently asked questions (FAQs) about calculating trade discount formula. These FAQs address common concerns and misconceptions, helping you understand how to apply the trade discount formula accurately.

Question 1: What is a trade discount formula?

Answer: A trade discount formula is a mathematical equation used to calculate the discounted price of a product or service. It involves multiplying the list price by the trade discount rate, resulting in the net price.

Question 2: How do I calculate a trade discount rate?

Answer: The trade discount rate is expressed as a percentage and is typically provided by the seller. It represents the reduction from the list price offered to the buyer.

Summary: Understanding the trade discount formula and its components is crucial for businesses to optimize their purchasing and pricing strategies. The key takeaways from these FAQs are:

- [Summary point 1]

- [Summary point 2]

- [Additional summary points]

The next section of this article will delve deeper into the practical applications of the trade discount formula, providing real-world examples and case studies to enhance your understanding.

Tips for Calculating Trade Discounts

This section provides practical tips and best practices to help you accurately calculate trade discounts and optimize your purchasing strategies.

Tip 1: Verify the List Price: Confirm the accuracy of the list price provided by the supplier, as it serves as the basis for all discount calculations.

Tip 2: Determine the Trade Discount Rate: Obtain the trade discount rate offered by the supplier. It can be expressed as a percentage or a fixed amount.

By following these tips, you can ensure accurate trade discount calculations, optimize your purchasing costs, and improve your profit margins.

The final section of this article will discuss advanced strategies for negotiating and leveraging trade discounts to maximize their impact on your business.

Conclusion

This article has provided a comprehensive overview of the trade discount formula, exploring its various components and practical applications. By understanding the concepts of list price, trade discount rate, and net price, businesses can effectively calculate trade discounts to optimize their purchasing strategies. Additionally, the discussion of complementary discounts, such as seasonal, quantity, and early payment discounts, highlights the importance of considering a holistic approach to trade discount calculations.

Key takeaways include:

- Accurately calculating trade discounts requires careful consideration of list price and trade discount rate.

- Complementary discounts can significantly reduce the net price paid by buyers when combined with the base trade discount.

- Negotiating favorable trade discount terms and leveraging them effectively can lead to substantial cost savings and improved profit margins.