” How to Calculate Forward Discount Factor” – A Comprehensive Guide

In international finance, the forward discount factor plays a critical role in managing currency exchange risks. It is the rate used to convert a future value of a currency to its present value, taking into account the difference in interest rates between two currencies. For instance, if the forward discount factor for the euro against the US dollar is 0.95, it means that one euro received in the future is currently worth $0.95.

Accurately calculating the forward discount factor is essential for businesses and investors to minimize foreign exchange losses and optimize profits. This concept has been instrumental in global trade and economic development since its inception in the early 20th century. This article will delve into the formula, applications, and practical considerations of calculating the forward discount factor, equipping readers with the knowledge to make informed decisions in a dynamic global financial landscape.

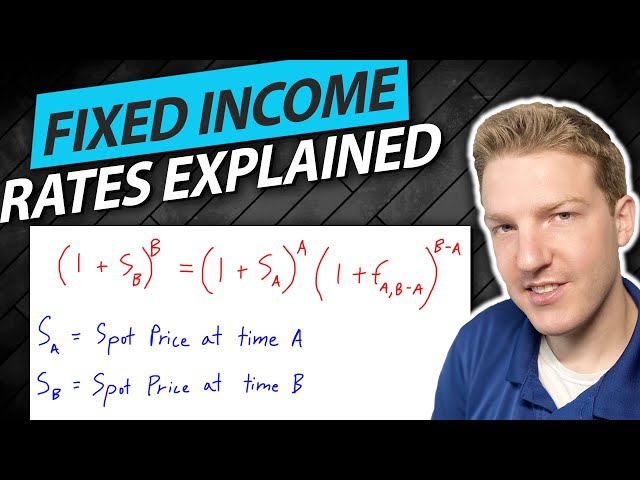

How to Calculate the Forward Discount Factor

The forward discount factor is a critical element in international finance, playing a pivotal role in managing foreign exchange risks. To effectively calculate it, certain key aspects must be considered:

- Spot exchange rate

- Forward exchange rate

- Interest rate differential

- Time to maturity

- Currency pair

- Risk premium

- Volatility

- Liquidity

- Economic conditions

Understanding these aspects is essential for accurate forward discount factor calculation. The spot exchange rate represents the current exchange rate, while the forward exchange rate reflects the expected future rate. The interest rate differential measures the difference in interest rates between the two currencies involved. Time to maturity refers to the duration until the future cash flow is received, and the currency pair indicates the two currencies being exchanged. The risk premium compensates for potential risks associated with currency fluctuations, and volatility gauges the potential for exchange rate movements. Liquidity measures the ease of buying or selling a currency, and economic conditions can influence interest rates and exchange rates. By considering these key aspects, businesses and investors can effectively calculate the forward discount factor, minimizing foreign exchange risks and optimizing global financial transactions.

Spot exchange rate

The spot exchange rate plays a crucial role in calculating the forward discount factor. It represents the current market value of one currency against another, determining the immediate exchange rate for a transaction. The spot exchange rate serves as a critical input in the formula for calculating the forward discount factor, which is used to convert future currency values to their present value.

Without the spot exchange rate, it would be impossible to calculate the forward discount factor accurately. The spot rate provides the starting point for determining the future value of a currency, taking into account factors like interest rate differentials and market expectations. By incorporating the spot rate, the forward discount factor can effectively predict future currency values and facilitate informed decision-making in international finance.

For instance, if a company plans to receive a payment in euros in three months and wants to calculate the present value of that payment in US dollars, it would need to consider the current spot exchange rate between the euro and the US dollar. The spot rate would represent the immediate exchange rate at which the company could convert euros to US dollars. By incorporating the spot rate into the forward discount factor calculation, the company can determine the present value of the future euro payment, taking into account interest rate differentials and market expectations.

Forward exchange rate

The forward exchange rate plays a critical role in calculating the forward discount factor. It represents the expected future exchange rate between two currencies at a specific point in time. This rate is a crucial input in the formula for calculating the forward discount factor, which is used to convert future currency values to their present value.

The forward exchange rate is influenced by several factors, including the spot exchange rate, interest rate differentials, and market expectations. It serves as a predictor of future currency values, enabling businesses and investors to manage foreign exchange risks effectively. By incorporating the forward exchange rate into the forward discount factor calculation, companies can determine the present value of future cash flows, facilitating informed decision-making in international finance.

For instance, if a company expects to receive a payment in euros in three months and wants to calculate the present value of that payment in US dollars, it would need to consider the forward exchange rate between the euro and the US dollar for three months. This rate would represent the expected exchange rate at which the company could convert euros to US dollars in three months. By incorporating the forward exchange rate into the forward discount factor calculation, the company can determine the present value of the future euro payment, taking into account interest rate differentials and market expectations.

In summary, the forward exchange rate is a critical component of calculating the forward discount factor, providing a forward-looking perspective on currency values. Understanding the relationship between the forward exchange rate and the forward discount factor is essential for businesses and investors to mitigate foreign exchange risks and optimize their financial strategies in the global marketplace.

Interest rate differential

Interest rate differential is a critical component in calculating the forward discount factor, as it represents the difference in interest rates between two currencies. This differential directly affects the calculation of the forward discount factor, which is used to convert future currency values to their present value. A higher interest rate differential leads to a higher forward discount factor, while a lower differential results in a lower forward discount factor.

In real-life scenarios, interest rate differentials play a significant role in currency markets. For example, if the interest rate in the United States is higher than in the Eurozone, the forward discount factor for the euro against the US dollar will be lower. This means that the euro is expected to depreciate against the US dollar in the future, as investors will be more inclined to hold US dollars due to the higher interest rates. Conversely, if the interest rate in the Eurozone is higher than in the United States, the forward discount factor for the euro against the US dollar will be higher, indicating an expectation of euro appreciation.

Understanding the connection between interest rate differential and the forward discount factor is crucial for businesses and investors involved in international transactions. By incorporating interest rate differentials into their calculations, they can make informed decisions about currency hedging strategies, foreign investment opportunities, and managing foreign exchange risks. Accurate calculation of the forward discount factor, considering interest rate differentials, enables businesses to optimize their financial performance and mitigate potential losses due to currency fluctuations.

Time to maturity

Time to maturity plays a critical role in calculating the forward discount factor, as it factors in the time value of money and the associated interest rate risk. A longer time to maturity leads to a greater impact of interest rate changes on the forward discount factor. This is because the present value of a future cash flow decreases as the time to maturity increases, due to the effect of compounding interest. As a result, the forward discount factor will be lower for longer time horizons, reflecting the higher risk and uncertainty associated with predicting future exchange rates over an extended period.

In real-life applications, time to maturity is a critical component of forward discount factor calculations. For instance, a company that expects to receive a payment in a foreign currency in six months will need to consider the time to maturity when calculating the forward discount factor. A longer time to maturity would result in a lower forward discount factor, indicating a lower expected value for the future cash flow due to the potential for interest rate fluctuations and currency depreciation. This understanding enables businesses to make informed decisions about hedging strategies and currency risk management.

Furthermore, the relationship between time to maturity and the forward discount factor highlights the importance of considering the timing of foreign exchange transactions. By understanding how time to maturity affects the forward discount factor, businesses can optimize their currency exchange strategies and mitigate potential losses due to adverse exchange rate movements. This is particularly important for long-term international contracts or investments, where the time value of money and interest rate risk play a significant role in determining the present value of future cash flows.

Currency pair

In calculating the forward discount factor, the currency pair is a crucial element that determines the exchange rate and interest rates used in the formula. It represents the two currencies involved in the foreign exchange transaction, and understanding its components and implications is essential for accurate calculations.

- Base currency

The base currency is the currency that is being converted into the quote currency. For example, if you want to calculate the forward discount factor for the euro against the US dollar, the euro would be the base currency.

- Quote currency

The quote currency is the currency that the base currency is being converted into. In the previous example, the US dollar would be the quote currency.

- Exchange rate

The exchange rate is the rate at which the base currency can be exchanged for the quote currency. It is a key input in calculating the forward discount factor.

- Interest rates

Interest rates are another important input in calculating the forward discount factor. They represent the cost of borrowing money in each currency, and the difference between the two interest rates affects the forward discount factor.

The currency pair and its components play a significant role in determining the forward discount factor and, consequently, the present value of future cash flows. By considering the base currency, quote currency, exchange rate, and interest rates, businesses and investors can make informed decisions about currency hedging strategies, foreign investments, and managing foreign exchange risks.

Risk premium

In calculating the forward discount factor, the risk premium is a critical component that reflects the additional return demanded by investors for assuming currency risk. It represents the compensation for the uncertainty and potential losses associated with currency fluctuations. The risk premium is incorporated into the forward discount factor formula to adjust for the perceived riskiness of the base currency relative to the quote currency.

The risk premium is influenced by various factors, such as political and economic stability, inflation rates, and the overall perceived risk of the base currency. A higher risk premium indicates a greater demand for compensation by investors, leading to a higher forward discount factor. Conversely, a lower risk premium suggests a lower perceived risk, resulting in a lower forward discount factor.

In real-life applications, the risk premium plays a significant role in currency markets. For instance, if investors perceive the euro to be riskier than the US dollar, they will demand a higher risk premium when converting euros to US dollars. This higher risk premium will be reflected in a higher forward discount factor for the euro against the US dollar. By incorporating the risk premium into their calculations, businesses and investors can make informed decisions about currency hedging strategies and foreign investments, mitigating potential losses due to adverse exchange rate movements.

Volatility

In calculating the forward discount factor, volatility plays a crucial role in assessing the risk associated with currency fluctuations. It measures the degree of price variability in the foreign exchange market, influencing the forward discount factor and the overall risk profile of currency transactions.

- Historical Volatility

Historical volatility measures the past price fluctuations of a currency pair, providing insights into its stability and potential for future movements. High historical volatility indicates a more unpredictable currency, leading to a higher risk premium and a higher forward discount factor.

- Implied Volatility

Implied volatility is derived from option prices and reflects market expectations of future price volatility. It provides a forward-looking perspective on currency fluctuations, influencing the pricing of currency options and the calculation of the forward discount factor.

- Correlation

Correlation measures the relationship between the volatility of different currency pairs. It helps in understanding how currencies move in relation to each other, enabling more accurate risk assessment and hedging strategies.

- Market Sentiment

Market sentiment reflects the overall sentiment of market participants towards a particular currency or currency pair. Positive sentiment can lead to lower volatility, while negative sentiment can contribute to higher volatility, impacting the forward discount factor and currency risk assessment.

In summary, volatility is a multifaceted concept that significantly influences the calculation of the forward discount factor. By considering historical volatility, implied volatility, correlation, and market sentiment, businesses and investors can better assess currency risk and make informed decisions about hedging strategies and foreign exchange transactions.

Liquidity

In the context of calculating the forward discount factor, liquidity plays a crucial role in determining the ease and efficiency of executing foreign exchange transactions. It refers to the ability of a currency to be bought or sold in the market without significantly impacting its price.

- Market Depth

Market depth measures the availability of buyers and sellers in the foreign exchange market. A deep market indicates a large number of participants, leading to tighter spreads and lower transaction costs, which can influence the calculation of the forward discount factor.

- Trading Volume

Trading volume refers to the total amount of currency traded in a given period. High trading volume indicates a liquid market with active participation, reducing the risk of price manipulation and providing more accurate forward discount factor calculations.

- Order Size

The size of currency orders can affect liquidity. Larger orders may have a greater impact on the market price, leading to wider spreads and higher transaction costs. This can influence the forward discount factor calculation, especially for large currency transactions.

- Market Volatility

Market volatility measures the fluctuations in currency prices. High volatility can make it difficult to predict future exchange rates accurately, which can impact the calculation of the forward discount factor. In volatile markets, liquidity may also decrease as participants become more cautious.

Understanding the various aspects of liquidity is essential for accurately calculating the forward discount factor. By considering market depth, trading volume, order size, and market volatility, businesses and investors can make informed decisions about currency hedging strategies, foreign investments, and managing foreign exchange risks.

Economic conditions

Economic conditions play a significant role in shaping the forward discount factor calculation. Economic conditions encompass various factors that influence currency values, interest rates, and overall market sentiment. Understanding the relationship between economic conditions and the forward discount factor is critical for accurate currency forecasting and effective risk management.

Economic growth, inflation, unemployment rates, and political stability are key economic conditions that affect the forward discount factor. Strong economic growth often leads to higher interest rates, making the domestic currency more attractive to investors. This, in turn, can result in a higher forward discount factor, indicating an expectation of currency appreciation. Conversely, economic slowdown or recessionary conditions can lead to lower interest rates and a weaker currency, resulting in a lower forward discount factor.

For example, during periods of economic expansion, central banks may raise interest rates to curb inflation. Higher interest rates make it more attractive for investors to hold the domestic currency, leading to an appreciation in its value. Consequently, the forward discount factor for the domestic currency against foreign currencies will be higher, reflecting the expected appreciation.

In summary, economic conditions are a critical component of calculating the forward discount factor. By considering economic growth, inflation, unemployment rates, and political stability, businesses and investors can make informed decisions about currency hedging strategies, foreign investments, and managing foreign exchange risks. Understanding the relationship between economic conditions and the forward discount factor enables better forecasting of currency movements and more effective risk mitigation in the global financial markets.

Frequently Asked Questions about Calculating the Forward Discount Factor

This section provides answers to common questions and clarifies essential aspects of calculating the forward discount factor.

Question 1: What is the forward discount factor used for?

The forward discount factor is used to convert future currency values to their present value, considering interest rate differentials and other factors, enabling informed decision-making in foreign exchange markets.

Question 2: What factors influence the forward discount factor?

The forward discount factor is influenced by the spot exchange rate, forward exchange rate, interest rate differential, time to maturity, currency pair, risk premium, volatility, liquidity, and economic conditions.

Question 3: How do interest rate differentials affect the forward discount factor?

Higher interest rate differentials lead to a higher forward discount factor, while lower differentials result in a lower forward discount factor. This is because interest rate differentials impact the value of currencies over time.

Question 4: What is the role of time to maturity in calculating the forward discount factor?

Time to maturity affects the forward discount factor due to the time value of money and interest rate risk. A longer time to maturity leads to a lower forward discount factor, reflecting the uncertainty associated with predicting future exchange rates over extended periods.

Question 5: How does volatility impact the forward discount factor?

Volatility measures currency price fluctuations and influences the forward discount factor. Higher volatility indicates greater uncertainty and risk, leading to a higher risk premium and a higher forward discount factor.

Question 6: What are the key takeaways from these FAQs?

Understanding the components and factors influencing the forward discount factor is crucial for accurate currency forecasting and effective risk management in international finance.

This comprehensive overview of frequently asked questions provides a solid foundation for further exploration of forward discount factor calculations and their applications in global financial markets.

Tips for Calculating the Forward Discount Factor

Accurately calculating the forward discount factor is crucial for effective foreign exchange management. Here are some practical tips to enhance your calculations:

Tip 1: Use reliable data sources. Utilize reputable sources for spot and forward exchange rates, interest rates, and other relevant economic data to ensure accurate calculations.

Consider time value of money. The time to maturity significantly impacts the forward discount factor. Factor in the time value of money to account for the present value of future cash flows.

Assess risk and volatility. The risk premium and volatility play a role in determining the forward discount factor. Evaluate these factors to adjust for potential fluctuations in exchange rates.

Understand economic conditions. Economic growth, inflation, and political stability influence currency values. Consider these conditions to make informed assumptions about future exchange rates.

Utilize technology. Utilize financial calculators or online tools specifically designed for forward discount factor calculations to streamline the process and minimize errors.

Seek professional guidance. If needed, consult with financial experts or currency specialists for guidance on complex forward discount factor calculations or hedging strategies.

By following these tips, you can improve the accuracy and effectiveness of your forward discount factor calculations, facilitating better decision-making in international finance.

Applying these tips will enable you to navigate foreign exchange markets with greater confidence and mitigate currency risks associated with global transactions and investments.

Conclusion

Understanding the forward discount factor is pivotal in international finance, providing a framework to calculate the present value of future currency flows. This article has explored the intricacies of calculating the forward discount factor, shedding light on key factors such as spot exchange rate, forward exchange rate, interest rate differential, time to maturity, and risk premium. By considering these elements and utilizing reliable data sources, businesses and investors can make informed decisions in foreign exchange markets and mitigate currency risks.

In summary, the forward discount factor serves as a valuable tool for managing foreign exchange exposure. It enables accurate forecasting of future currency values, facilitating effective hedging strategies. As the global economy continues to evolve, understanding and applying the forward discount factor will remain essential for thriving in international financial markets.