Discount calculation in Excel is a crucial skill for professionals handling financial data. Calculating discounts accurately ensures accurate financial reporting, invoice processing, and budget management.

In today’s business environment, accurate discount calculation is essential for maximizing profits, managing cash flow, and making informed decisions. Historically, discounts were calculated manually, which was time-consuming and prone to errors. However, with the advent of Excel, discount calculations have become faster, easier, and more efficient.

This article delves into the fundamentals of discount calculation in Excel, providing step-by-step instructions and practical examples to guide users through various discount scenarios.

How to Calculate Discount Excel

Discount calculation in Excel plays a crucial role in business operations such as financial reporting, invoice processing, and budget management. To master this skill, it is essential to understand the key aspects of discount calculation in Excel.

- Formula Syntax

- Discount Percentage

- Discount Amount

- Net Price

- Multiple Discounts

- Conditional Discounts

- Date-Based Discounts

- Error Handling

- Automation

These aspects cover the fundamental concepts, different types of discounts, advanced features, and practical considerations related to discount calculation in Excel. Understanding and applying these aspects effectively will enable users to maximize the accuracy, efficiency, and flexibility of their Excel-based discount calculations.

Formula Syntax

Formula syntax is the foundation upon which discount calculation in Excel is built. It defines the structure and order of elements within a formula, ensuring that Excel can interpret and execute the calculation correctly. Without a proper understanding of formula syntax, users may encounter errors or incorrect results in their discount calculations.

As an integral component of discount calculation in Excel, formula syntax dictates how different values and operators are combined to arrive at the desired result. It encompasses elements such as cell references, mathematical operators, and functions, all of which must be arranged in a logical and syntactically correct manner.

For instance, a simple discount calculation formula in Excel might look like this: =A1 B1, where A1 contains the original price and B1 contains the discount percentage. This formula uses the multiplication operator () to calculate the discount amount, which is then subtracted from the original price to yield the net price. Understanding the syntax of this formula allows users to modify and adapt it to suit their specific discount calculation needs.

Discount Percentage

Discount percentage is a fundamental aspect of calculating discounts in Excel. It represents the percentage reduction applied to the original price of an item or service, determining the amount of savings or price reduction offered. Understanding and accurately applying discount percentages is crucial for businesses and individuals to optimize their financial transactions and make informed decisions.

- Absolute Discount: A fixed amount of reduction applied to the original price, regardless of the item’s value.

- Percentage Discount: A percentage reduction applied to the original price, resulting in a proportional decrease.

- Tiered Discount: A discount structure that offers different discount percentages based on purchase quantity or customer loyalty.

- Seasonal Discount: A discount offered for a limited time during specific seasons or holidays.

Discount percentages have significant implications in various business contexts. They can be used to attract new customers, increase sales volume, clear excess inventory, and enhance customer loyalty. By understanding the different types of discount percentages and their applications, businesses can tailor their discount strategies to achieve specific objectives and maximize their profits.

Discount Amount

Discount amount, closely intertwined with “how to calculate discount excel,” represents the absolute reduction in price resulting from the application of a discount percentage. It is a crucial component of discount calculation in Excel, serving as the basis for determining the net price or final cost of an item or service.

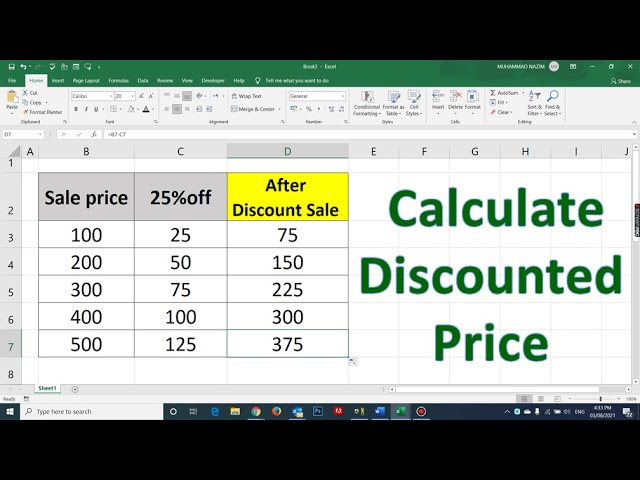

Calculating the discount amount involves multiplying the original price by the discount percentage. For example, if an item with an original price of $100 receives a 10% discount, the discount amount would be $10. This amount is then deducted from the original price to arrive at the net price of $90.

Discount amount plays a significant role in various business scenarios. Retailers use it to mark down prices during sales and promotions, attracting customers and increasing sales volume. In financial transactions, discount amount is applied to invoices to reflect discounts offered to customers for early payment or bulk purchases. Furthermore, discount amount is a key consideration in budgeting and forecasting, enabling businesses to plan for revenue and expenses accurately.

Understanding the connection between discount amount and “how to calculate discount excel” empowers users to make informed decisions regarding pricing, discounts, and financial planning. By leveraging Excel’s capabilities, businesses can automate discount calculations, ensuring accuracy and consistency in their financial operations.

Net Price

Within the context of “how to calculate discount excel,” “Net Price” holds a pivotal position as the final price of an item or service after the application of discounts. The connection between these concepts is intrinsic and reciprocal, as calculating the Net Price is the ultimate goal of discount calculation in Excel.

Discount calculation in Excel involves determining the Discount Amount, which is then deducted from the Original Price to arrive at the Net Price. This calculation is crucial for businesses and individuals alike, enabling them to determine the actual price they will pay or receive for goods or services.

In practical terms, Net Price plays a vital role in various financial transactions. For instance, in retail, the Net Price reflects the price customers pay after applying discounts and promotions. In invoicing, the Net Price is the amount due from the customer after any applicable discounts have been accounted for. Furthermore, Net Price is a critical component in budgeting and forecasting, allowing businesses to accurately plan for revenue and expenses.

Multiple Discounts

Within the realm of “how to calculate discount excel,” multiple discounts emerge as a prevalent concept that profoundly impacts the calculation of Net Price. This aspect involves applying successive or combined discounts to a single item or service, resulting in a more significant price reduction compared to a single discount.

- Sequential Discounts: Discounts applied in a specific order, where each subsequent discount is calculated based on the Net Price after the previous discount has been applied.

- Concurrent Discounts: Discounts applied simultaneously, where the total discount is calculated by combining the individual discount percentages.

- Tiered Discounts: Discounts offered based on purchase quantity or customer loyalty, where different discount percentages are applied to different tiers of purchases.

- Conditional Discounts: Discounts granted only if certain conditions are met, such as early payment or bulk purchases.

Understanding and correctly applying Multiple Discounts is crucial for businesses and individuals seeking to maximize savings or optimize pricing strategies. By considering the various types of Multiple Discounts and their implications in “how to calculate discount excel,” users can ensure accuracy and efficiency in their financial calculations.

Conditional Discounts

Within the multifaceted world of “how to calculate discount excel,” “Conditional Discounts” stand out as a versatile and potent tool for businesses seeking to implement targeted pricing strategies. Conditional Discounts introduce a layer of flexibility to discount calculations by allowing discounts to be applied only when specific conditions are met. This opens up a wide range of possibilities for businesses to incentivize desired customer behaviors, optimize inventory management, and enhance customer loyalty.

The connection between “Conditional Discounts” and “how to calculate discount excel” is bidirectional. On one hand, Conditional Discounts leverage the computational capabilities of Excel to automate and streamline the application of complex discount rules. On the other hand, Excel provides a structured framework within which Conditional Discounts can be defined, managed, and applied consistently across large datasets.

In practice, Conditional Discounts manifest in various forms. For instance, an online retailer may offer a discount to customers who purchase a specific combination of products, such as a laptop and a printer. Alternatively, a manufacturer may provide a discount to distributors who achieve a certain sales target within a specified period. These real-life examples showcase the adaptability of Conditional Discounts to diverse business scenarios.

Date-Based Discounts

Date-Based Discounts, a prevalent concept within “how to calculate discount excel,” hold significant sway over the calculation of Net Price. These discounts are applied based on specific dates or time periods, introducing a dynamic element to discount calculations. The connection between Date-Based Discounts and “how to calculate discount excel” lies in the conditional nature of these discounts, which hinge upon the fulfillment of specific date-related criteria.

In practice, Date-Based Discounts manifest in various forms. Early Bird Discounts, for instance, incentivize timely purchases by offering a discount to customers who make purchases before a specified date. Conversely, Last Minute Discounts aim to clear inventory by providing discounts on products nearing their expiration dates. Seasonal Discounts, tied to specific times of the year, are a common strategy to boost sales during off-seasons.

Understanding the mechanics of Date-Based Discounts is crucial for businesses seeking to optimize their pricing strategies and maximize revenue. By leveraging the capabilities of Excel, businesses can automate the application of Date-Based Discounts, ensuring accuracy and consistency in their financial calculations. Additionally, businesses can tailor Date-Based Discounts to align with their specific business objectives, such as increasing sales during peak seasons or reducing inventory levels.

Error Handling

Error Handling plays a crucial role in “how to calculate discount excel” by ensuring the accuracy and reliability of discount calculations. It involves techniques for identifying, managing, and recovering from errors that may arise during the calculation process, enhancing the robustness and usability of Excel-based discount calculations.

- Data Validation: Checking the validity and accuracy of input data to prevent errors from occurring in the first place.

- Error Trapping: Identifying and intercepting errors during calculation to prevent them from propagating and causing unintended consequences.

- Error Correction: Correcting detected errors automatically or providing guidance to users on how to resolve them.

- Error Reporting: Displaying informative error messages to users, helping them understand the cause of the error and take appropriate action.

By incorporating these Error Handling techniques into “how to calculate discount excel,” users can minimize the impact of errors, maintain data integrity, and ensure the reliability of their financial calculations. Moreover, it empowers them to identify and address errors promptly, reducing the risk of incorrect decision-making and financial losses.

Automation

Automation, a powerful tool within the realm of “how to calculate discount excel,” streamlines and enhances the process of discount calculations. By leveraging Excel’s automation capabilities, users can minimize manual effort, improve accuracy, and increase efficiency in their financial operations.

The integration of Automation into “how to calculate discount excel” has a profound impact on the overall calculation process. Automation allows users to define formulas and rules that are automatically applied to data, eliminating the need for manual calculations and reducing the risk of errors. This enables businesses to handle large volumes of discount calculations quickly and accurately, ensuring timely and reliable financial reporting.

Real-life examples of Automation in “how to calculate discount excel” abound. Businesses use automated Excel spreadsheets to calculate discounts based on complex pricing structures, such as tiered discounts, seasonal discounts, and conditional discounts. These spreadsheets automatically apply the appropriate discount rules to each transaction, ensuring consistent and accurate pricing across multiple sales channels.

Understanding the connection between Automation and “how to calculate discount excel” empowers businesses to optimize their financial processes. By embracing Automation, businesses can save time, reduce errors, and gain valuable insights into their pricing strategies. This understanding is essential for businesses seeking to stay competitive in today’s fast-paced business environment, where efficiency and accuracy are paramount.

Frequently Asked Questions

This FAQ section provides answers to common questions and clarifies key concepts related to “how to calculate discount excel”.

Question 1: What is the formula to calculate the discount amount?

Answer: The discount amount is calculated by multiplying the original price by the discount percentage. For example, if the original price is $100 and the discount percentage is 10%, the discount amount would be $10.

Question 6: How can I automate discount calculations in Excel?

Answer: Excel provides various automation features, such as formulas, conditional formatting, and macros, that can be used to automate discount calculations. This can save time and reduce errors in complex or repetitive calculations.

These FAQs address common pain points and provide practical guidance for effectively calculating discounts in Excel. For further in-depth exploration of advanced discount calculation techniques and strategies, refer to the next section of this article.

Transition: Delving into advanced discount calculation techniques can empower users to handle complex pricing scenarios, optimize revenue, and make informed financial decisions.

Tips for Effective Excel Discount Calculations

This section presents practical tips to help you master discount calculations in Excel, ensuring accuracy, efficiency, and optimization of your financial operations.

Tip 1: Understand the Formula Syntax: Grasp the correct syntax for discount calculation formulas, including the order and usage of operators and cell references.

Tip 2: Use Absolute and Relative References: Employ absolute references ($) to lock cell values, ensuring formula accuracy when copying or moving formulas.

Tip 3: Leverage Conditional Formatting: Apply conditional formatting rules to highlight discounted cells or indicate different discount categories, enhancing data visualization.

Tip 4: Create a Discount Table: Establish a central table that lists discount percentages for various products or categories, enabling quick and easy application of discounts.

Tip 5: Automate with Macros: Record macros to automate repetitive discount calculation tasks, saving time and minimizing errors.

Tip 6: Validate Input Data: Implement data validation rules to ensure that input values, such as prices and discount percentages, are within acceptable ranges.

Tip 7: Handle Errors Gracefully: Use error handling techniques to trap and manage errors during discount calculations, preventing incorrect results from propagating.

Tip 8: Leverage Excel Functions: Explore Excel functions like IF(), SUMIF(), and VLOOKUP() to perform complex discount calculations based on conditions or lookup values.

By following these tips, you can enhance the accuracy, efficiency, and flexibility of your Excel-based discount calculations, empowering you to make informed financial decisions and optimize your business operations.

The next section of this article will delve into advanced discount calculation techniques, providing strategies for handling complex pricing scenarios and maximizing revenue.

Conclusion

Through a comprehensive exploration of “how to calculate discount excel,” this article has illuminated key concepts, formulas, and techniques that empower users to perform accurate and efficient discount calculations. Understanding the interplay between discount percentage, discount amount, and net price enables businesses to optimize pricing strategies and maximize revenue.

Automation, conditional formatting, and error handling techniques enhance the capabilities of Excel for discount calculations. By embracing these advanced features, businesses can streamline their financial operations, reduce errors, and gain valuable insights into their pricing models. Furthermore, the integration of Excel with other software and data sources opens up possibilities for dynamic and real-time discount calculations, enabling businesses to stay competitive in an ever-changing market landscape.