Discount percentage calculation, the mathematical formula for determining the proportionate reduction in price, holds immense relevance in both personal finance and business transactions. Imagine purchasing a coveted item marked down from $100 to $75 – calculating the discount percentage empowers you to assess the savings accurately.

Understanding discount percentage calculation not only equips consumers with informed decision-making but also enables businesses to optimize pricing strategies. Its historical roots trace back to the concept of percentage, developed by Persian mathematician Al-Khwarizmi in the 9th century.

In this comprehensive guide, we delve into the intricacies of discount percentage calculation, exploring its formula, variations, and practical applications across diverse scenarios.

How to Calculate for Discount Percentage

Discount percentage calculation forms the bedrock of astute financial decision-making. Its key aspects encompass:

- Formula

- Variations

- Retail

- Coupons

- Bulk Discounts

- Taxes

- Markup

- Profit Margin

- Negotiation

Understanding these aspects empowers consumers to decipher discounts accurately, while businesses leverage them to optimize pricing strategies. For instance, comprehending the formula empowers businesses to set discounts that maximize revenue. Similarly, consumers can utilize discount variations to identify the most advantageous offers.

Formula

The formula for calculating discount percentage lies at the heart of understanding how discounts work. It establishes the precise mathematical relationship between the original price, the discounted price, and the discount percentage. Without this formula, determining the exact discount being offered would be a matter of guesswork and estimation.

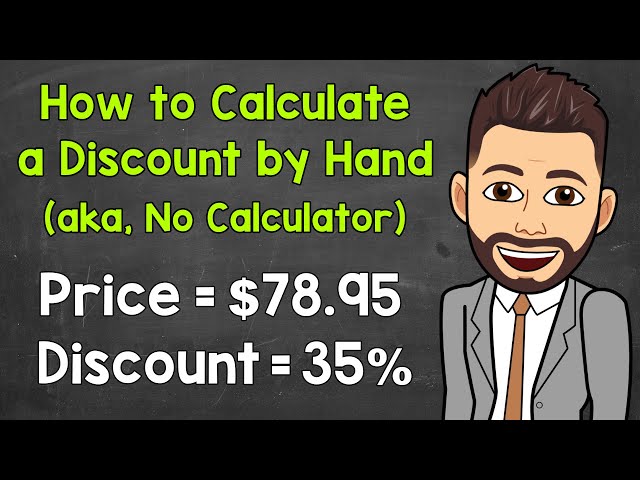

The formula, expressed as Discount Percentage = ((Original Price – Discounted Price) / Original Price) x 100, empowers individuals to calculate the discount percentage with accuracy and confidence. This calculation finds practical applications in a myriad of real-life scenarios, from assessing the true value of a sale to comparing different discount offers and making informed purchasing decisions.

Understanding the formula also enables businesses to strategize their pricing and discounting policies effectively. By manipulating the variables within the formula, businesses can determine the optimal discount percentage to offer while still maintaining desired profit margins. This understanding empowers them to maximize revenue and stay competitive in the marketplace.

In summary, the formula for calculating discount percentage is an indispensable tool for both consumers and businesses alike. It provides a precise and reliable method for determining the extent of a discount, facilitating informed decision-making and strategic planning.

Variations

Variations in discount percentage calculations arise due to diverse factors, including the type of discount, applicable taxes, and negotiation strategies. Understanding these variations empowers individuals and businesses to accurately assess and compare discounts, ensuring informed decision-making.

- Discount Types

Discounts can take various forms, such as flat discounts (fixed amount), percentage discounts (percentage off the original price), and bulk discounts (reduced price for purchasing larger quantities). Each type requires a specific calculation method. - Taxes

In some jurisdictions, taxes are applied to the original price before calculating the discount. This can affect the effective discount percentage received by the customer. - Negotiation

In certain situations, discounts may be subject to negotiation between the buyer and seller. This can result in variations from the initially advertised discount percentage. - Markup

Businesses often apply a markup to their products, which represents the difference between the cost and selling price. Understanding the markup can help determine the true discount percentage being offered.

Grasping the nuances of discount percentage variations is crucial for both consumers and businesses. It enables consumers to make informed purchasing decisions by comparing offers accurately. For businesses, understanding variations helps optimize pricing strategies, maximize revenue, and enhance customer satisfaction.

Retail

Within the realm of discount percentage calculation, retail takes center stage as a primary domain where discounts are prevalent. Understanding its multifaceted nature empowers consumers and businesses to navigate the complexities of retail pricing and make informed decisions.

- Customer Segmentation

Retailers often segment customers based on factors such as loyalty, purchase history, and demographics. This segmentation influences the discount strategies and targeted promotions offered to different customer groups.

- Product Categories

Discounts vary across different product categories. Essential items, such as groceries, typically have lower discounts compared to discretionary items, such as electronics, which may have higher discounts to stimulate demand.

- Sales Seasons

Retailers implement strategic discounts during specific sales seasons, such as end-of-season sales, holidays, and clearance events. These discounts aim to increase sales volume and clear inventory.

- Competition

Retailers monitor competitor pricing and promotions to remain competitive. This competitive landscape influences the discount percentages offered to attract and retain customers.

In summary, the retail landscape significantly influences discount percentage calculations. Factors such as customer segmentation, product categories, sales seasons, and competition all play a role in shaping retail pricing strategies. Understanding these dynamics empowers consumers to identify genuine discounts and make informed purchasing decisions, while businesses can optimize their pricing to maximize revenue and customer satisfaction.

Coupons

Within the realm of discount percentage calculation, coupons stand out as a widely prevalent form of discount mechanism. Understanding their intricacies equips consumers and businesses alike to navigate the complexities of retail pricing and make informed decisions.

- Types of Coupons

Coupons come in various forms, including manufacturer coupons, store coupons, and digital coupons. Each type has its own eligibility criteria and redemption process, influencing the calculation of discount percentage.

- Discount Value

Coupons offer discounts in different forms, such as fixed amounts, percentages, or “buy one, get one free” promotions. The discount value directly impacts the calculation of discount percentage, determining the actual savings for the customer.

- Redemption Channels

Coupons can be redeemed through various channels, including in-store, online, and mobile apps. The redemption channel may affect the calculation of discount percentage due to factors such as additional fees or restrictions.

- Validity Period

Coupons typically have a validity period, beyond which they expire and can no longer be redeemed. This aspect influences the calculation of discount percentage, as expired coupons hold no value.

In essence, understanding coupons and their multifaceted nature is crucial for accurately calculating discount percentage. By considering factors such as coupon type, discount value, redemption channels, and validity period, consumers can maximize savings, while businesses can effectively plan and execute targeted promotions.

Bulk Discounts

Bulk discounts, a prominent aspect of discount percentage calculation, offer reduced prices for purchasing larger quantities. Understanding their mechanics empowers consumers to identify advantageous offers and businesses to optimize pricing strategies.

- Unit Price Reduction

Bulk discounts typically lower the unit price as the quantity purchased increases. This reduction in price directly impacts the calculation of discount percentage.

- Tiered Discounts

Businesses may implement tiered discounts, offering different discount percentages based on specific quantity thresholds. This influences the calculation, as the applicable discount percentage varies with the quantity.

- Minimum Order Quantity

Bulk discounts often come with minimum order quantity requirements. Understanding these requirements is crucial, as they determine the eligibility for the discount and subsequent percentage calculation.

- Product Assortment

Bulk discounts may be offered on a specific product or an assortment of products. The product assortment impacts the calculation, as the discount percentage may vary depending on the items included.

In summary, bulk discounts introduce various factors that influence discount percentage calculation. By considering unit price reduction, tiered discounts, minimum order quantity, and product assortment, consumers can astutely evaluate bulk discount offers. Likewise, businesses can strategically design bulk discount programs to attract customers and optimize revenue.

Taxes

Taxes and discount percentage calculations are intricately intertwined, with taxes often serving as a critical component in determining the actual discount received by consumers. In many jurisdictions, taxes are applied to the original price of an item before any discounts are applied. This can significantly impact the effective discount percentage, as the tax amount reduces the overall savings.

For example, consider an item with an original price of $100 and a discount of 20%. If the applicable tax rate is 10%, the discount calculation would proceed as follows:

- Discounted price without tax: $100 x 0.80 = $80

- Tax amount: $80 x 0.10 = $8

- Discounted price with tax: $80 + $8 = $88

- Effective discount percentage: (($100 – $88) / $100) x 100 = 12%

As evident from this example, the effective discount percentage is lower than the advertised 20% due to the impact of taxes.

Understanding the relationship between taxes and discount percentage calculations is crucial for both consumers and businesses. Consumers can make more informed purchasing decisions by considering the impact of taxes on the overall savings, while businesses can adjust their pricing and discount strategies to account for tax implications and maintain desired profit margins.

Markup

Markup, a fundamental concept in pricing and discount calculation, establishes the relationship between the cost of a product and its selling price. It directly influences the discount percentage offered to customers, making it an integral component of the discount calculation process.

Markup is typically expressed as a percentage of the cost price. For example, if a product costs $50 and the markup is 20%, the selling price becomes $60. This markup directly affects the discount percentage, as a higher markup results in a lower discount percentage for the same selling price.

In practice, businesses carefully consider markup when determining discount percentages to ensure profitability while remaining competitive. Discounts are often calculated as a percentage of the markup rather than the original cost, providing businesses with flexibility in adjusting prices and maintaining desired profit margins.

For instance, if a product with a cost of $50 has a markup of 20% (selling price of $60), a 10% discount would be calculated as 10% of $10 (markup amount), resulting in a discounted price of $54. This approach allows businesses to maintain a consistent profit margin despite offering discounts.

Understanding the relationship between markup and discount percentage is essential for both businesses and consumers. Businesses can optimize their pricing strategies by considering the impact of markup on discount calculations, while consumers can make informed purchasing decisions by comparing discounted prices in relation to the original cost and markup. This understanding empowers all parties to engage in mutually beneficial transactions.

Profit Margin

Profit margin, a pivotal concept in the realm of business and economics, holds immense relevance in the context of calculating discount percentages. It establishes the relationship between a product’s cost and its selling price, influencing the amount of profit a business earns per unit sold.

- Markup

Markup, a key component of profit margin, represents the difference between the cost of a product and its selling price. It is typically expressed as a percentage of the cost and directly impacts the discount percentage offered to customers. - Cost Structure

The cost structure of a product, encompassing fixed and variable costs, is crucial in determining the profit margin. Fixed costs remain constant regardless of production volume, while variable costs fluctuate with production levels. - Sales Volume

Sales volume significantly influences profit margin, as it affects the overall revenue generated. Higher sales volumes can lead to economies of scale, reducing production costs and increasing profit margins. - Competition

Competitive market dynamics play a vital role in shaping profit margins. Intense competition may necessitate lower profit margins to remain competitive, while a lack of competition can allow for higher margins.

In conclusion, profit margin serves as a multifaceted concept that profoundly affects the calculation of discount percentages. By considering markup, cost structure, sales volume, and competition, businesses can make strategic decisions regarding pricing and discounts while ensuring profitability. Understanding profit margin empowers businesses to optimize their pricing strategies and maximize revenue.

Negotiation

In the realm of discount percentage calculation, negotiation emerges as a pivotal aspect, influencing the final discount received. It involves a dynamic interplay between parties, each with their own objectives, seeking mutually acceptable terms.

- BATNA

Before entering negotiations, it is crucial to establish a Best Alternative to a Negotiated Agreement (BATNA). This represents the course of action you will take if negotiations fail, empowering you to walk away from unfavorable terms.

- Concessions

Negotiation often involves making concessions to reach a compromise. Understanding the value of concessions and being prepared to make strategic trade-offs can lead to more favorable outcomes.

- Communication

Effective communication is paramount in negotiation. Clearly articulating your goals, actively listening to the other party, and employing empathy can foster understanding and facilitate progress.

- Timing

Timing plays a crucial role in negotiation. Identifying the right time to negotiate, applying pressure tactics judiciously, and being patient can significantly impact the outcome.

By considering these facets of negotiation, individuals can navigate the complexities of discount percentage calculation more effectively. Negotiation empowers consumers to secure better deals and enables businesses to optimize their pricing strategies while maintaining customer satisfaction.

Frequently Asked Questions

This section addresses common queries and misconceptions regarding the calculation of discount percentages, providing clear and concise answers to enhance understanding.

Question 1: What is the formula for calculating discount percentage?

Discount Percentage = ((Original Price – Discounted Price) / Original Price) x 100

Question 2: How does tax affect discount percentage?

Taxes are often applied to the original price, reducing the effective discount percentage. Consider taxes in your calculations for a more accurate representation.

Question 3: What is the difference between discount percentage and discount amount?

Discount percentage represents the proportional reduction in price, while discount amount is the absolute value of the reduction.

Question 4: How do I calculate discount percentage for bulk purchases?

Bulk discounts typically offer reduced unit prices. Calculate the discount percentage based on the difference between the regular unit price and the bulk unit price.

Question 5: What is the relationship between markup and discount percentage?

Markup is the difference between cost and selling price. A higher markup leads to a lower discount percentage for the same selling price.

Question 6: Can negotiation influence discount percentage?

Negotiation can impact the final discount received. Prepare your Best Alternative to a Negotiated Agreement (BATNA), consider concessions, and communicate effectively to optimize outcomes.

These FAQs provide valuable insights into the nuances of discount percentage calculation, empowering you to confidently assess and compare discounts, make informed purchasing decisions, and optimize your pricing strategies.

In the next section, we delve into advanced applications of discount percentage calculation, exploring its use in complex scenarios and strategic decision-making.

Tips for Calculating Discount Percentage

This section provides practical tips to help you calculate discount percentages accurately and confidently.

Tip 1: Understand the Formula

Grasp the discount percentage formula to correctly determine the discount rate for any given scenario.

Tip 2: Consider Taxes

Remember that taxes can impact the effective discount percentage. Account for taxes in your calculations to avoid discrepancies.

Tip 3: Differentiate Between Discount Percentage and Discount Amount

Recognize the distinction between discount percentage, which represents the proportional reduction, and discount amount, which is the absolute value of the savings.

Tip 4: Calculate Discount Percentage for Bulk Purchases

When dealing with bulk discounts, calculate the discount percentage based on the difference between the regular unit price and the bulk unit price.

Tip 5: Understand the Relationship Between Markup and Discount Percentage

Be aware that markup, the difference between cost and selling price, affects the discount percentage. A higher markup results in a lower discount percentage for the same selling price.

Tip 6: Leverage Negotiation Skills

Negotiation can influence the final discount percentage. Prepare your Best Alternative to a Negotiated Agreement (BATNA) and employ effective negotiation strategies.

Summary:

By following these tips, you can enhance your ability to calculate discount percentages accurately, enabling you to make informed decisions and optimize your financial outcomes.

These tips serve as a foundation for the concluding section, where we will explore advanced applications of discount percentage calculation and its significance in strategic decision-making.

Conclusion

This comprehensive guide has explored the intricacies of discount percentage calculation, equipping you with the knowledge and skills to determine discounts accurately. Understanding the formula, considering taxes, distinguishing between discount percentage and amount, and leveraging negotiation strategies are crucial for informed decision-making.

The insights gained from this article empower you to make astute financial choices, optimize pricing strategies, and negotiate favorable terms. Whether you are a consumer seeking the best deals or a business owner aiming to maximize revenue, the ability to calculate discount percentages is essential.