How do you find the Trade Discount Rate, commonly referred to as finding the discount rate, is a business calculation used to determine the percentage of discount offered on a product or service prior to any additional taxes or fees. For instance, if a product has a list price of $100 and is offered with a 20% trade discount, the discount rate would be $20.

Understanding the trade discount rate plays a crucial role in establishing competitive pricing strategies, maximizing profits, and maintaining customer satisfaction. Historically, this concept has evolved over time; however, its relevance remains significant in modern business practices, particularly in wholesale and retail industries.

In this article, we will explore the various methods used to calculate the trade discount rate, discuss its importance and benefits, and provide practical tips on how to effectively utilize this calculation in business transactions.

How do you find the Trade Discount Rate

Understanding the various dimensions of how do you find the trade discount rate is essential for businesses to optimize pricing, maximize profits, and enhance customer satisfaction. This concept encompasses several key aspects that collectively contribute to its significance in business transactions.

- Calculation methods: Percentage, amount, and series.

- Discount types: Trade, cash, and quantity.

- Pricing strategies: Competitive pricing, cost-plus pricing, and value-based pricing.

- Profitability analysis: Impact on gross and net profit margins.

- Customer satisfaction: Offering competitive discounts to attract and retain customers.

- Historical evolution: Changes in trade discount practices over time.

- Legal compliance: Adherence to regulations governing discounts and promotions.

- Industry best practices: Benchmarking against industry standards for discount rates.

- Technology advancements: Automation of discount calculations and tracking.

Exploring these aspects in detail provides a comprehensive understanding of how do you find the trade discount rate. For instance, businesses can leverage different calculation methods to determine the optimal discount rate based on their specific needs. Understanding the various discount types allows businesses to tailor their offerings to different customer segments. Furthermore, analyzing the impact of trade discounts on profitability helps businesses make informed decisions regarding pricing and inventory management.

Calculation methods

Understanding the various calculation methods for trade discounts is crucial in determining the appropriate discount rate. These methods include percentage, amount, and series discounts, each with its unique application and impact on the final price. The choice of calculation method depends on factors such as industry norms, product type, and business objectives.

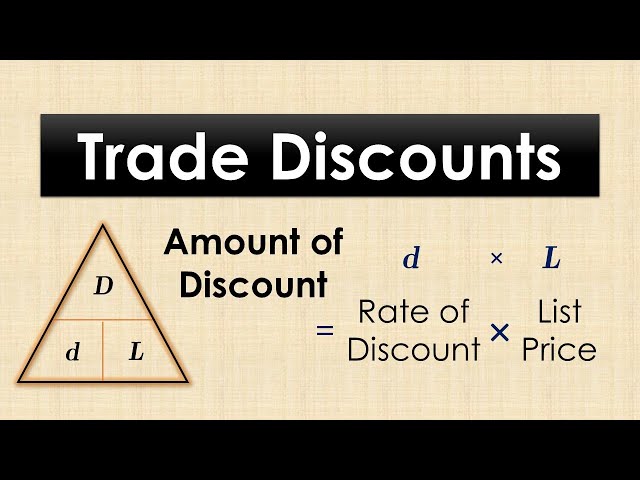

The percentage discount method directly applies a percentage to the list price to determine the discount amount. For example, a 20% discount on a product with a list price of $100 would result in a discount of $20. The amount discount method, on the other hand, specifies a fixed discount amount rather than a percentage. Using the same example, an amount discount of $20 would reduce the price to $80.

Series discounts involve applying multiple discounts sequentially. For instance, a product with a list price of $100 may have a series discount of 10%, followed by an additional 5%. The first discount reduces the price to $90, and the second discount further reduces it to $85.50. Series discounts are often used to offer larger discounts for bulk purchases or to incentivize purchases of multiple products.

Selecting the appropriate calculation method for trade discounts requires careful consideration of the desired outcome and the specific business context. By understanding the connection between calculation methods and the resulting discount rate, businesses can optimize their pricing strategies, enhance profitability, and improve customer satisfaction.

Discount types

The connection between discount types and the calculation of trade discount rates is fundamental, as the type of discount applied directly impacts the discount rate and the final price paid by the customer. Trade discounts, cash discounts, and quantity discounts are the most common types of discounts offered in business transactions, each with its unique characteristics and implications for the trade discount rate.

Trade discounts are offered to specific groups of customers, such as wholesalers, distributors, or retailers, and are typically based on the volume of purchases made. The trade discount rate is calculated as a percentage of the list price and is deducted before any other discounts or fees are applied. Cash discounts, on the other hand, are offered for early payment and are typically expressed as a percentage discount for payment within a specified period, such as 2% for payment within 10 days. Quantity discounts are offered to customers who purchase large quantities of a product and are typically calculated as a tiered discount based on the number of units purchased.

Understanding the different discount types and their impact on the trade discount rate is crucial for businesses to effectively manage their pricing and maximize profitability. By carefully selecting the appropriate discount type and calculating the trade discount rate accordingly, businesses can tailor their offerings to specific customer segments, incentivize desired behaviors such as early payment or bulk purchases, and optimize their cash flow.

For instance, a business offering a 10% trade discount to wholesalers would calculate the discount rate as $10 for a product with a list price of $100. If the wholesaler then offers a 5% cash discount for payment within 15 days, the customer would receive an additional $5 discount, resulting in a total discount of $15 and a final price of $85. Similarly, a business offering a tiered quantity discount of 5% for purchases over 10 units and 10% for purchases over 20 units would calculate the trade discount rate based on the quantity purchased by the customer.

Pricing strategies

Pricing strategies play a critical role in determining the trade discount rate, as they establish the foundation for setting the initial price of a product or service. Competitive pricing involves setting prices based on the prices of similar products or services offered by competitors. Cost-plus pricing involves setting prices based on the total cost of producing or acquiring the product or service, plus a desired profit margin. Value-based pricing involves setting prices based on the perceived value of the product or service to the customer.

The choice of pricing strategy directly impacts the calculation of the trade discount rate. For example, in competitive pricing, businesses may offer trade discounts to match or undercut competitor prices, thereby influencing the trade discount rate. In cost-plus pricing, trade discounts may be used to incentivize bulk purchases or to clear excess inventory, affecting the trade discount rate accordingly. In value-based pricing, trade discounts may be offered to enhance the perceived value of the product or service, potentially leading to higher trade discount rates.

Understanding the connection between pricing strategies and the trade discount rate is essential for businesses to optimize their pricing, maximize profitability, and meet customer expectations. By carefully selecting the appropriate pricing strategy and calculating the trade discount rate accordingly, businesses can position their products or services effectively in the market, differentiate themselves from competitors, and drive sales.

Profitability analysis

Profitability analysis is a critical aspect of understanding the impact of trade discounts on a business’s financial performance. By examining the relationship between trade discount rates and gross and net profit margins, businesses can make informed decisions regarding pricing and discount strategies.

- Revenue impact: Trade discounts directly impact revenue by reducing the selling price of products or services. Understanding this impact is crucial for forecasting sales and managing cash flow.

- Cost of goods sold: Trade discounts can affect the cost of goods sold if they are calculated based on the cost of the product. This can impact gross profit margins and overall profitability.

- Gross profit margin: Gross profit margin is the difference between revenue and the cost of goods sold. Trade discounts influence gross profit margin by affecting both revenue and cost.

- Net profit margin: Net profit margin is the difference between gross profit and operating expenses. Trade discounts can indirectly impact net profit margin by affecting gross profit and other expenses related to sales.

Analyzing the impact of trade discounts on profitability requires careful consideration of all these facets. By evaluating the potential effects on revenue, cost, and profit margins, businesses can optimize their trade discount strategies to maximize profitability and achieve financial goals.

Customer satisfaction

The connection between “Customer satisfaction: Offering competitive discounts to attract and retain customers” and “how do you find the trade discount rate” lies in understanding how discounts impact customer behavior and overall profitability. Offering competitive discounts can be a strategic move to enhance customer satisfaction and drive repeat business.

Trade discounts are an essential pricing mechanism that affects the final price paid by customers. By calculating the trade discount rate accurately, businesses can determine the optimal discount to offer while maintaining profitability. A well-calculated trade discount rate can increase customer satisfaction by providing perceived value and encouraging purchases.

Real-life examples abound in various industries. For instance, retail stores often offer discounts during sales events to attract customers and clear inventory. Airlines provide tiered discounts based on frequent flyer status to retain loyal customers. Subscription services offer discounts for longer subscription periods to increase customer lifetime value.

Understanding the relationship between customer satisfaction and trade discount rates allows businesses to make informed pricing decisions. By offering competitive discounts, businesses can attract new customers, increase customer loyalty, and drive sales. However, it’s crucial to find the right balance to avoid eroding profit margins while maximizing customer satisfaction.

Historical evolution

The historical evolution of trade discount practices has a profound impact on how we find the trade discount rate today. In the past, trade discounts were primarily calculated manually, a time-consuming and error-prone process. However, with the advent of technology, automated systems have been developed to streamline the calculation process, making it faster, more accurate, and more efficient.

One of the most significant changes in trade discount practices over time is the shift from fixed to dynamic discounts. In the past, trade discounts were often fixed percentages, regardless of factors such as purchase volume or customer loyalty. Today, it is common for businesses to offer tiered discounts based on these factors, allowing them to reward loyal customers and encourage larger purchases.

Another notable change is the increasing use of data analytics in trade discount calculation. Businesses now have access to vast amounts of data on customer behavior, purchase history, and market trends. This data can be used to create more accurate and personalized trade discount rates, optimizing profitability and customer satisfaction.

Understanding the historical evolution of trade discount practices provides valuable insights into the current state of the art. By leveraging modern technology and data analytics, businesses can find the trade discount rate that is most appropriate for their specific needs, maximizing profitability and customer loyalty.

Legal compliance

Identifying the trade discount rate is intrinsically linked to an understanding of the legal compliance framework that governs discounts and promotions. Adherence to these regulations ensures ethical and responsible business practices, protects consumer rights, and fosters a fair competitive landscape.

- Truth in advertising: Trade discounts must be accurately represented, avoiding deceptive or misleading claims that could mislead customers.

- Antitrust laws: Businesses must avoid collusive practices, such as price-fixing or market allocation, which can harm competition and consumers.

- Consumer protection laws: Trade discounts should not be used to engage in unfair or predatory practices that exploit vulnerable consumers.

- Tax implications: Businesses must consider the tax implications of trade discounts, ensuring proper reporting and compliance with tax regulations.

Understanding these legal considerations empowers businesses to navigate the complexities of trade discount practices, safeguard their reputation, and maintain legal compliance. Adherence to regulations not only mitigates legal risks but also fosters trust among customers and promotes ethical business practices within the industry.

Industry best practices

Understanding industry best practices for benchmarking against industry standards for discount rates is crucial in “how do you find the trade discount rate.” By analyzing industry norms and aligning with established standards, businesses can optimize their trade discount strategies, enhance competitiveness, and maximize profitability while adhering to ethical guidelines.

- Competitive Analysis: Regularly monitoring competitor pricing, discount structures, and industry trends helps businesses stay informed and make data-driven decisions regarding their own trade discount rates.

- Customer Segmentation: Dividing customers into distinct groups based on factors such as purchase history, loyalty, and industry affiliation allows businesses to tailor trade discounts and maximize customer satisfaction.

- Market Research: Conducting thorough market research to understand customer needs, preferences, and price sensitivity provides valuable insights for setting appropriate trade discount rates.

- Legal Compliance: Staying abreast of industry regulations and legal requirements ensures that trade discount practices comply with antitrust laws, consumer protection regulations, and tax implications.

Benchmarking against industry standards for discount rates empowers businesses to make informed decisions, optimize pricing strategies, and maintain a competitive edge. By incorporating these best practices into their trade discount calculations, businesses can increase profitability, foster customer loyalty, and navigate the complexities of the modern business landscape.

Technology advancements

The convergence of “Technology advancements: Automation of discount calculations and tracking” and “how do you find the trade discount rate” has revolutionized the way businesses calculate and manage discounts. Automation has streamlined the process, increased accuracy, and provided deeper insights, transforming the way trade discounts are determined.

Historically, calculating trade discounts was a manual and time-consuming task, prone to human error. With the advent of technology, automated systems have emerged, leveraging algorithms and software to swiftly and accurately calculate discounts based on predefined rules and parameters. This automation not only saves time and reduces errors but also allows businesses to handle complex discount structures and large volumes of transactions efficiently.

Beyond calculation, automation has extended to tracking and monitoring discounts. Businesses can now track the usage, effectiveness, and ROI of their discount programs in real-time. This data empowers them to make informed decisions, optimize their discount strategies, and identify areas for improvement. For instance, businesses can analyze which discounts are most popular, which products or services are driving the most revenue through discounts, and which customer segments are responding best to different discount offers.

In summary, “Technology advancements: Automation of discount calculations and tracking” has become an indispensable part of “how do you find the trade discount rate.” Automation has brought speed, accuracy, and deeper insights to the process, enabling businesses to optimize their discount strategies, maximize profitability, and enhance customer satisfaction. As technology continues to evolve, we can expect further advancements in discount calculation and tracking, providing businesses with even more powerful tools to drive growth and success.

Frequently Asked Questions about Finding the Trade Discount Rate

This FAQ section addresses common questions and misconceptions related to “how do you find the trade discount rate,” providing clear and concise answers to guide your understanding.

Question 1: What is the purpose of calculating the trade discount rate?

Answer: The trade discount rate helps businesses determine the discounted price of products or services offered to specific customers or groups, such as wholesalers or retailers. It plays a crucial role in pricing strategies, profitability analysis, and customer satisfaction.

Question 2: What are the common methods used to find the trade discount rate?

Answer: The three primary methods are:

- Percentage discount: A direct percentage reduction from the list price.

- Amount discount: A fixed dollar amount deducted from the list price.

- Series discount: A combination of multiple discounts applied sequentially.

Question 3: How does the trade discount rate impact profitability?

Answer: Offering trade discounts can reduce revenue and affect gross and net profit margins. However, it can also lead to increased sales volume and customer loyalty, potentially offsetting the impact on profitability.

Question 4: What factors should be considered when determining the trade discount rate?

Answer: Factors to consider include industry norms, competitive pricing, customer loyalty, purchase volume, and overall business objectives.

Question 5: How can technology assist in finding the trade discount rate?

Answer: Automated systems and software can streamline discount calculations, reduce errors, and provide real-time tracking of discount usage and effectiveness.

Question 6: What are some best practices for managing trade discounts?

Answer: Best practices include benchmarking against industry standards, segmenting customers for targeted discounts, and monitoring discount performance to optimize strategies.

These FAQs provide valuable insights into the calculation and management of trade discount rates. In the following section, we will explore advanced strategies and case studies to further enhance your understanding of this critical business concept.

Tips for Finding the Trade Discount Rate

Understanding the different dimensions of “how do you find the trade discount rate” is essential for businesses to optimize pricing, maximize profits, and enhance customer satisfaction. This TIPS section provides actionable recommendations to guide you in effectively calculating and managing trade discount rates.

Tip 1: Determine the Calculation Method: Choose the appropriate method (percentage, amount, or series) based on industry norms, product type, and business objectives.

Tip 2: Consider Discount Types: Understand the different types of discounts (trade, cash, quantity) and their impact on the trade discount rate.

Tip 3: Analyze Pricing Strategies: Align trade discount rates with your pricing strategy (competitive, cost-plus, or value-based) to optimize profitability.

Tip 4: Calculate Profitability Impact: Analyze the effect of trade discounts on gross and net profit margins to make informed decisions about pricing.

Tip 5: Enhance Customer Satisfaction: Offer competitive discounts to attract and retain customers, fostering loyalty and repeat purchases.

Tip 6: Comply with Regulations: Adhere to legal requirements governing discounts and promotions to avoid legal risks and maintain ethical business practices.

Tip 7: Benchmark against Industry Standards: Monitor competitor pricing and industry norms to ensure your trade discount rates are competitive and aligned with market conditions.

Tip 8: Leverage Technology: Utilize automated systems to streamline discount calculations, track usage, and gain insights for optimizing discount strategies.

In summary, these tips provide a roadmap for effectively finding the trade discount rate and managing discounts to enhance profitability, customer satisfaction, and overall business success.

In the concluding section of this article, we will explore advanced strategies and case studies to further enhance your understanding of trade discount rate management and its impact on business performance.

Conclusion

This article has provided a comprehensive exploration of “how do you find the trade discount rate,” shedding light on its significance, calculation methods, and impact on business profitability and customer satisfaction. Key insights include the interconnectedness of discount types, pricing strategies, and legal compliance in determining the appropriate trade discount rate.

The article emphasizes the importance of understanding industry best practices and leveraging technology to optimize trade discount rate management. By aligning discounts with business objectives and customer needs, businesses can effectively attract and retain customers, drive sales, and maximize profits. The interplay of these factors underscores the dynamic nature of trade discount rate determination, requiring businesses to continuously evaluate and adjust their strategies to stay competitive and profitable.