Understanding Trade Discount Calculations: A Guide to Unlocking Savings

Calculating trade discount amounts is a crucial aspect of finance, as it enables businesses and individuals to determine the actual price of goods and services after applying discounts offered by manufacturers, wholesalers, or retailers. A trade discount is a percentage reduction from the list price or retail price offered to specific customers or groups, such as wholesalers purchasing in bulk.

Understanding how to calculate trade discounts provides numerous benefits, including optimized cost management, enhanced inventory valuation, and improved financial planning. Historically, trade discounts emerged as a means of incentivizing larger purchases and fostering stronger supplier-buyer relationships. Today, trade discounts remain a cornerstone of commercial transactions, influencing pricing strategies and determining the profitability of businesses.

In this comprehensive guide, we will delve into the intricacies of calculating trade discount amounts, exploring practical formulas and examples to ensure you can accurately determine the net price of goods and services and make informed purchasing decisions.

How to Calculate Trade Discount Amount

Understanding how to calculate trade discount amounts is essential for businesses and individuals involved in commercial transactions. Key aspects to consider include:

- List price

- Trade discount rate

- Net price

- Trade discount amount

- Invoice amount

- Complementary discount

- Chain discount

- Quantity discount

- Seasonal discount

These aspects are interconnected and play a crucial role in determining the actual price paid for goods and services. By understanding the calculation process and considering these factors, businesses can optimize their purchasing strategies, manage costs effectively, and enhance their financial performance.

List price

List price, also known as the manufacturer’s suggested retail price (MSRP), is a critical component of calculating trade discount amounts. It represents the recommended retail price of a product or service and serves as the basis for determining discounts offered to various customers or groups.

Understanding the relationship between list price and trade discount calculations is essential for businesses and individuals involved in commercial transactions. Trade discounts are typically expressed as a percentage reduction from the list price, which means that a higher list price will result in a higher trade discount amount. For instance, if a product has a list price of $100 and a trade discount of 20%, the trade discount amount would be $20. This relationship highlights the importance of considering the list price when determining the actual price paid for goods and services.

In practical applications, list price plays a crucial role in inventory valuation and financial planning. Businesses need to accurately account for the list price and trade discounts received to determine the cost of goods sold and maintain proper inventory records. Furthermore, understanding the impact of trade discounts on list price enables businesses to optimize their pricing strategies and maximize profitability.

In summary, list price is a fundamental element in calculating trade discount amounts, as it establishes the baseline for determining the discounted price. Businesses must carefully consider the list price and associated trade discounts to make informed purchasing decisions, manage costs effectively, and enhance their financial performance.

Trade Discount Rate

The trade discount rate holds significant importance in calculating trade discount amounts. It represents the percentage reduction offered on the list price of a product or service, determining the actual price paid by the customer. The trade discount rate directly influences the trade discount amount, with a higher discount rate leading to a larger discount amount. Understanding this relationship is crucial for businesses and individuals involved in commercial transactions.

Consider a scenario where a product has a list price of $100. If the trade discount rate is 20%, the trade discount amount would be $20, resulting in a net price of $80. Conversely, if the trade discount rate increases to 30%, the trade discount amount becomes $30, further reducing the net price to $70. This demonstrates the direct impact of the trade discount rate on the calculation of trade discount amounts.

The practical applications of understanding the relationship between trade discount rate and trade discount amount are numerous. Businesses can leverage this knowledge to negotiate favorable trade discounts, optimize their purchasing strategies, and enhance their financial performance. By accurately calculating trade discount amounts, businesses can maintain proper inventory records, determine the cost of goods sold, and make informed decisions regarding pricing and profitability.

In summary, the trade discount rate is a critical component of calculating trade discount amounts. Its direct impact on the discount amount underscores the importance of considering this rate when determining the actual price paid for goods and services. Understanding this relationship empowers businesses to optimize their purchasing strategies, manage costs effectively, and enhance their financial performance.

Net price

Within the context of calculating trade discount amounts, understanding net price is crucial. It represents the actual price paid for goods or services after deducting the trade discount from the list price. accurately calculating net price enables businesses and individuals to determine the true cost of their purchases and make informed decisions regarding pricing and profitability.

- Discounted price

The discounted price is the list price minus the trade discount amount. It represents the price paid before any additional discounts or surcharges are applied.

- Complementary discount

A complementary discount is an additional discount offered on top of the trade discount. It is typically a smaller percentage and can be applied to specific products or services.

- Quantity discount

A quantity discount is a discount offered for purchasing large quantities of a product or service. It incentivizes bulk purchases and can result in significant savings.

These facets of net price are interconnected and influence the overall cost of goods or services. By considering these factors, businesses and individuals can optimize their purchasing strategies, manage costs effectively, and enhance their financial performance.

Trade discount amount

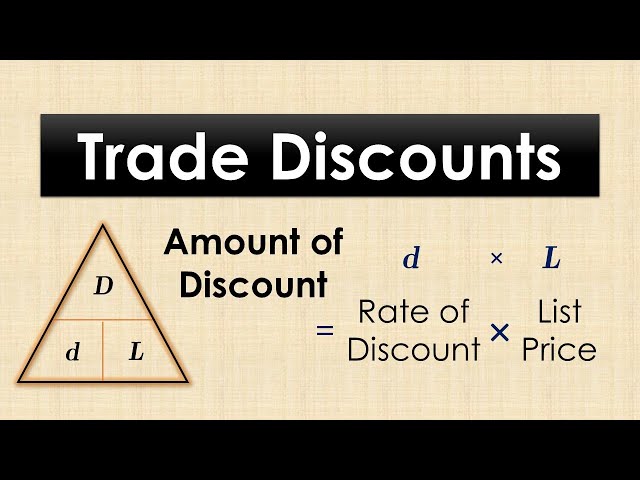

Trade discount amount is a critical component of “how to calculate trade discount amount”, as it represents the actual reduction in price offered to customers or groups. It is calculated by multiplying the trade discount rate by the list price of the product or service. Understanding this relationship is crucial for businesses and individuals involved in commercial transactions to accurately determine the net price they will pay.

In practical applications, trade discount amount plays a significant role in inventory valuation, cost management, and financial planning. Businesses need to consider the trade discount amount when determining the cost of goods sold and maintaining proper inventory records. This understanding enables them to optimize their purchasing strategies, negotiate favorable trade discounts, and enhance their financial performance.

To illustrate the connection between trade discount amount and how to calculate trade discount amount, consider the following example: If a product has a list price of $100 and a trade discount rate of 20%, the trade discount amount would be $20, resulting in a net price of $80. This demonstrates the direct impact of trade discount amount on the calculation of the actual price paid for goods and services.

In summary, trade discount amount is a crucial element in calculating the actual price paid for goods and services. Understanding this relationship empowers businesses to optimize their purchasing strategies, manage costs effectively, and enhance their financial performance.

Invoice amount

Invoice amount plays a significant role within the broader context of “how to calculate trade discount amount”. It represents the total amount due for goods or services purchased, after considering any applicable trade discounts and other adjustments. Understanding the components and implications of invoice amount is crucial for businesses and individuals involved in commercial transactions to ensure accurate calculations and informed decision-making.

- Subtotal

The subtotal is the sum of the list prices of all items included in the invoice, before any discounts or adjustments are applied. It serves as the base amount upon which trade discounts and other calculations are applied.

- Trade discount

The trade discount is the amount deducted from the subtotal based on the agreed-upon trade discount rate. It represents the reduction in price offered to customers or groups for bulk purchases or other considerations.

- Complementary discount

A complementary discount is an additional discount offered on top of the trade discount. It is typically a smaller percentage and can be applied to specific products or services, further reducing the invoice amount.

- Shipping and handling

Shipping and handling charges are additional costs associated with the delivery of goods or services. They are typically added to the invoice amount and can vary depending on the mode of shipment, distance, and weight of the items.

These components of invoice amount are interconnected and influence the overall cost of goods or services. By considering these factors, businesses and individuals can optimize their purchasing strategies, manage costs effectively, and enhance their financial performance.

Complementary discount

Complementary discounts, closely intertwined with “how to calculate trade discount amount”, offer an additional layer of price reduction beyond the standard trade discount. Understanding and incorporating complementary discounts into calculations empowers businesses and individuals to optimize their purchasing strategies, manage costs effectively, and enhance their financial performance.

- Tiered discounts

Tiered discounts grant progressively larger complementary discounts based on the quantity of items purchased. This strategy incentivizes bulk purchases and encourages customers to increase their order size.

- Seasonal discounts

Seasonal discounts are complementary discounts offered during specific times of the year, such as holidays or off-seasons. They aim to boost sales during traditionally slow periods and clear out inventory.

- Loyalty discounts

Loyalty discounts reward repeat customers for their continued patronage. They can be structured as tiered discounts based on the number of purchases or the total amount spent over time.

- Promotional discounts

Promotional discounts are temporary complementary discounts offered to attract new customers or promote specific products or services. They are often used to generate excitement and drive sales.

By considering these facets of complementary discounts, businesses and individuals can tailor their purchasing strategies to maximize savings. Complementary discounts, when strategically combined with trade discounts, can significantly reduce the overall cost of goods or services, positively impacting profitability and financial performance.

Chain discount

Chain discount plays a pivotal role in “how to calculate trade discount amount”, offering a unique mechanism to apply multiple discounts sequentially. By understanding the relationship between chain discount and trade discount calculations, businesses and individuals can optimize their purchasing strategies, maximize cost savings, and enhance their financial performance.

Chain discounts are commonly used when multiple parties are involved in the distribution channel, such as manufacturers, wholesalers, and retailers. Each party may offer their own trade discount, creating a chain of discounts that are applied consecutively. The total discount is calculated by multiplying the individual discounts together, resulting in a significant reduction from the original list price.

For example, consider a product with a list price of $100. The manufacturer offers a trade discount of 20%, followed by a distributor discount of 10%, and finally a retailer discount of 5%. The chain discount calculation would be as follows: $100 x (1 – 0.20) x (1 – 0.10) x (1 – 0.05) = $73.50. This represents a total discount of 26.5% and a net price of $73.50.

Understanding the practical applications of chain discounts is crucial for businesses. By incorporating chain discounts into their calculations, businesses can accurately determine the actual cost of goods purchased, optimize inventory management, and make informed decisions regarding pricing and profitability. Moreover, understanding chain discounts can assist businesses in negotiating favorable terms with suppliers and distributors, leading to improved cash flow and overall financial performance.

Quantity discount

Quantity discount plays a significant role within “how to calculate trade discount amount”. It centers around the concept of offering reduced pricing for customers who purchase larger quantities of goods or services. Understanding this connection empowers businesses and individuals to optimize their purchasing strategies, maximize cost savings, and enhance their financial performance.

Quantity discounts are commonly used in various industries, such as wholesale distribution, manufacturing, and retail. By offering reduced pricing for larger purchases, businesses incentivize customers to buy in bulk, leading to increased sales volume and improved inventory turnover. Consequently, businesses can benefit from reduced storage costs, streamlined order fulfillment, and enhanced cash flow.

Real-life examples of quantity discounts abound. For instance, a construction company purchasing a large quantity of building materials may receive a discount from the supplier. Similarly, a restaurant placing a bulk order for food supplies may qualify for reduced pricing from the distributor. These examples highlight how quantity discounts can provide significant cost savings for businesses.

From a practical standpoint, understanding the connection between quantity discount and “how to calculate trade discount amount” is crucial. Businesses need to accurately calculate the net price of goods or services, considering both the trade discount and the quantity discount. This understanding enables informed decision-making regarding pricing, inventory management, and supplier negotiations. Additionally, it helps businesses optimize their purchasing strategies to maximize cost savings and profitability.

Seasonal discount

Within the context of “how to calculate trade discount amount”, seasonal discounts hold significant importance. These discounts are offered during specific times of the year, typically to clear out inventory or boost sales during traditionally slow periods. Understanding the various facets of seasonal discounts empowers businesses and individuals to optimize their purchasing strategies, maximize cost savings, and enhance their financial performance.

- Timing and Duration

Seasonal discounts are offered for a limited time, typically coinciding with specific seasons or holidays. This time-bound nature creates a sense of urgency and encourages customers to make purchases during the promotional period.

- Product Category

Seasonal discounts are often applied to specific product categories that are associated with particular seasons or occasions. For example, winter clothing may be discounted during the holiday season, while swimwear may be discounted during the summer.

- Discount Percentage

The discount percentage offered during seasonal sales can vary significantly. Businesses may choose to offer small discounts to clear out excess inventory or substantial discounts to generate excitement and drive sales.

- Impact on Pricing

Seasonal discounts directly impact the calculation of trade discount amount. By incorporating seasonal discounts into their calculations, businesses can accurately determine the net price of goods or services, optimize inventory management, and make informed pricing decisions.

Understanding the dynamics of seasonal discounts enables businesses to tailor their purchasing strategies to take advantage of these promotional periods. By planning purchases around seasonal sales, businesses can reduce their overall costs, manage inventory levels effectively, and enhance their profitability. Moreover, understanding seasonal discounts helps businesses negotiate favorable terms with suppliers, leading to improved cash flow and overall financial performance.

Frequently Asked Questions

This comprehensive FAQ section addresses common queries and uncertainties surrounding “how to calculate trade discount amount”, providing clear and concise answers to guide your understanding.

Question 1: What is the formula for calculating trade discount amount?

Answer: Trade discount amount = List price Trade discount rate

Question 2: How does trade discount affect the net price?

Answer: Trade discount reduces the list price, resulting in a lower net price. Net price = List price – Trade discount amount

Question 3: Can multiple trade discounts be applied simultaneously?

Answer: Yes, chain discounts involve applying multiple discounts sequentially, resulting in a greater overall discount.

Question 4: How do seasonal discounts impact trade discount calculations?

Answer: Seasonal discounts, offered during specific times of the year, further reduce the net price after trade discounts are applied.

Question 5: What is the difference between trade discounts and quantity discounts?

Answer: Trade discounts are based on the customer’s status, while quantity discounts are offered for purchasing larger quantities.

Question 6: How can businesses use trade discount calculations to their advantage?

Answer: Understanding trade discount calculations allows businesses to optimize purchasing, negotiate favorable terms with suppliers, and enhance profitability.

In summary, these FAQs provide foundational insights into calculating trade discount amount, covering essential concepts, their impact on pricing, and practical considerations for businesses. As we delve deeper into this topic, we will explore advanced techniques and strategies for leveraging trade discounts to maximize cost savings and improve financial performance.

Proceed to Advanced Strategies for Calculating Trade Discount Amount

TIPS

This section provides actionable tips to help businesses optimize their use of trade discounts, maximize cost savings, and enhance their financial performance.

Tip 1: Negotiate Favorable Terms: Engage in effective negotiations with suppliers to secure the best possible trade discount rates and payment terms.

Tip 2: Leverage Quantity Discounts: Take advantage of quantity discounts offered for bulk purchases, especially when demand is consistent and storage capacity is available.

Tip 3: Plan for Seasonal Discounts: Time purchases strategically to coincide with seasonal discounts, allowing for significant savings on seasonal merchandise.

Tip 4: Explore Complementary Discounts: Inquire about complementary discounts, such as loyalty discounts or promotional discounts, that can further reduce the net price.

Tip 5: Calculate Accurately: Ensure accurate calculations of trade discount amounts to avoid overpayments and maintain proper accounting records.

Tip 6: Foster Supplier Relationships: Build strong relationships with suppliers who offer favorable trade discounts and reliable service.

Tip 7: Monitor Market Trends: Stay informed about industry trends and market conditions to identify opportunities for better trade discounts.

Tip 8: Use Technology: Utilize technology tools and software to automate trade discount calculations and streamline the purchasing process.

By implementing these tips, businesses can harness the power of trade discounts to reduce costs, enhance profitability, and gain a competitive edge in the marketplace.

In the concluding section, we will explore advanced strategies for leveraging trade discounts, building upon the foundational understanding established in this article.

Conclusion

Throughout this article, we have delved into the intricacies of calculating trade discount amounts, exploring various aspects that influence the net price paid for goods and services. Understanding the concepts of list price, trade discount rate, and net price forms the foundation for accurate calculations.

Key points to remember include:

- Trade discounts offer a reduction from the list price, resulting in a lower net price.

- Factors such as complementary discounts, quantity discounts, and seasonal discounts further impact the calculation of trade discount amounts.

- Businesses can leverage trade discounts to optimize purchasing, negotiate favorable terms, and enhance their overall financial performance.

By mastering the art of calculating trade discount amounts, businesses can gain a competitive edge, maximize cost savings, and unlock new opportunities for growth. As market dynamics continue to evolve, staying abreast of these concepts will remain crucial for businesses seeking to thrive in an increasingly competitive global marketplace.